Diffusion Finance is a decentralized exchange that runs on the Diffusion protocol. The crypto concept is a Uniswap V3 fork on the Evmos, which is a blockchain that is based on the Cosmos EVM. This peer-to-peer system is resistant to censorship and aims at providing enhanced security and efficient function. The self-custodial platform can function without trusted intermediaries that can restrict access selectively. This DEX was launched in the first quarter of 2022. We could not find info about the team members, the location of the company, etc.

Diffusion Finance overview

Some of the key features of this DEX as per the vendor are:

- The DEX uses the Automated Market Maker (AMM) instead of an order book.

- Buyers/sellers can trade directly with a liquidity pool.

- It is an open-source platform allowing features such as swap, liquidity, and the creation of new markets.

- DIFF is the native token of the platform.

- Funding methods include ERC tokens and Evmos tokens.

- The cosmos ecosystem that this DEX uses helps in seamless and cost-efficient transactions on the network .

How does Diffusion Finance work?

The DEX allows for all of the following:

- You can trade tokens available on the exchange including Evmos, CELR, USDT, and more. If you do not find the tokens that you want to trade for in the DEX’s list of tokens, you can use the import tokens feature.

- Under the pool feature, you can create a new pool with two tokens and add liquidity. You can also import a pool or add liquidity to an existing pool.

- The DEX provides liquidity tokens (DLP) whenever you add liquidity to the pool.

- You can sell, transfer or use the liquidity tokens as they are a tradable asset.

- Liquidity providers can deposit their LP tokens and accumulate DIFF rewards.

What can you buy on Diffusion Finance?

The DEX works on the Evmos blockchain which is based on the Cosmos Evmos network. The popular assets you can swap here are:

- Evmos

- DIFF

- WBTC

- WETH

- DAI

- ceBNB

- ceAVAX

- ceFTM

- ceAURORA

- CELR

- USDT

- madFRAX

- madFXS

- FRAX

- FXS

- mulDAI

Is Diffusion Finance safe?

While the vendor claims that the DEX aims at enabling a superior level of security, we could not find security info. The vendor does not provide information on the safety and security measures it uses for protecting user data and privacy.

Diffusion Finance fees, compatible wallets, and transactions

MetaMask and Wallet Connect are the two compatible wallets on the DEX. The platform charges a 0.3% fee for transactions. Pro-rata distribution of the fee is done to all the Diffusion Liquidity Providers on completion of the transaction. To retrieve liquidity and the accrued fees, liquidity providers need to burn the liquidity tokens and exchange them for their share of the liquidity pool and an additional proportional fee allocation.

What are the ways to trade on Diffusion Finance?

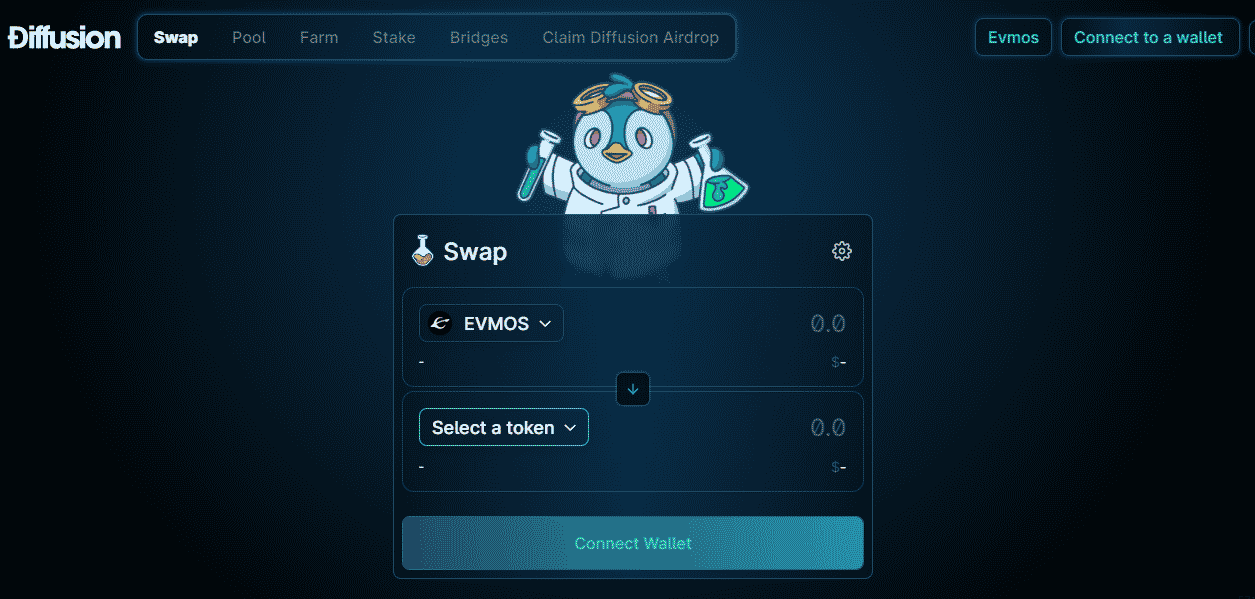

To trade on the DEX, you need to first connect your wallet to the exchange. Here are the steps to follow to connect your wallet to the exchange.

- Connect to the Evmos network

- Now connect Metamask wallet to the DEX by using the connect to a wallet option

- Connect your address or accounts to Metamask and click on the ‘next’ button

- Confirm the action and click on ‘connect’

- Now your wallet is connected when you see your account address and the Evmos balance you have in the account

Before you start trading, ensure you have sufficient Evmos tokens for the fees or to use the DEX for any other purpose.

The different ways to use the DEX are:

- Use liquidity tokens as tradable assets for selling, transferring, or in any other way they want.

- Swap tokens listed on the official site for swapping or import tokens if you cannot find the token you want on the platform.

- The DIFF tokens are used for liquidity mining rewards.

- You get Diffusion token rewards when you deposit your LP tokens

Customer support

For support, the vendor offers links to the social media pages on Twitter, Telegram, Discord, Github, and Medium.com.

Should you trade with Diffusion Finance?

Diffusion Finance summary

Diffusion Finance summaryPros

- Efficient liquidity provider for the cosmos EVM

- Multiple earning opportunities

Cons

- Lack of vendor transparency

- Insufficient info present on the deposit, withdrawal, and funding methods

- Newly formed platform with very little guidance and support for new users