Acala Swap is an open-source crypto exchange that uses Acala Dollar as a stable coin and is optimized for DeFi platforms. The DEX is compatible with Ethereum and allows traders to fund their accounts with the help of wallets. It does not come under any regulation and operates as a decentralized entity. We will cover all the crucial aspects of the platform to see if it can be a good choice for traders in their short and long-term investments.

Acala Swap overview

Acala Swap allows traders to swap a limited number of tokens and invest in liquidity pools. The main features of the DEX are:

- Access cross-chain assets with multiple cryptocurrencies

- Subject to continuous updates without forks

- A small gas fees

- Algorithmic risk management

- Available as an open-source on GitHub

What countries does Acala Swap support buying and selling in?

Due to its decentralized nature, traders worldwide can participate in buying and selling cryptos.

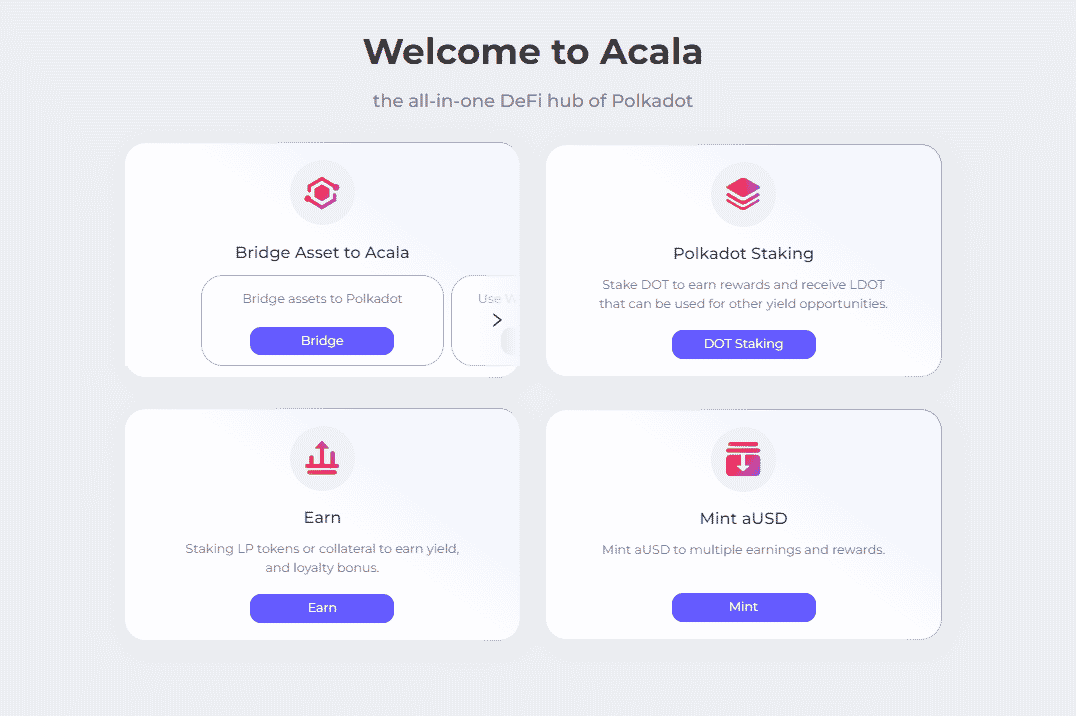

How does Acala Swap work?

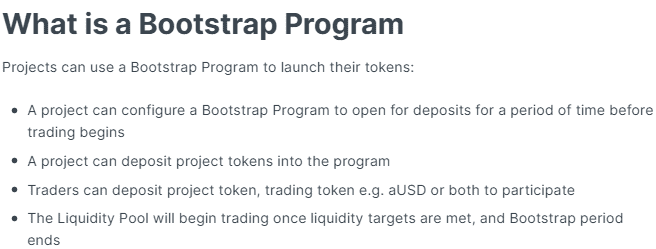

Traders can connect their cryptocurrency wallets such as Polkadot, Talisman, and Subwallet to get their funds with the DEX. After that, they can swap multiple tokens and add liquidity for earning interest. Bootstrap programs are available to launch your personal tokens.

What can you buy on Acala Swap?

Some of the significant tokens available at Acala Swap are:

- ACA

- DOT

- LDOT

- aUSD

- IcDOT

The number of available tokens at Acala Swap is limited. It misses out on several important cryptocurrencies such as BTC and Ethereum.

Is Acala Swap safe?

Decentralized exchanges do not come under the check and balance of regulators and governments. It can be subjected to forks and phishing attacks, putting your funds at risk.

Acala Swap fees, compatible wallets, and transactions

As mentioned before, the available wallets at Acala Swap are:

- Polkadot

- Talisman

- Subwallet

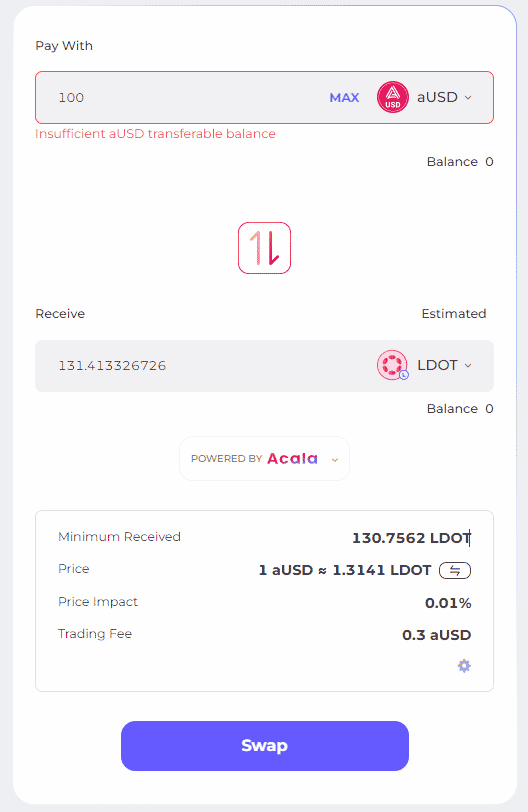

The trading fee can vary depending on the tokens you are swapping. For example, converting 100 aUSD to LDOT will incur a 0.3 aUSD in charges.

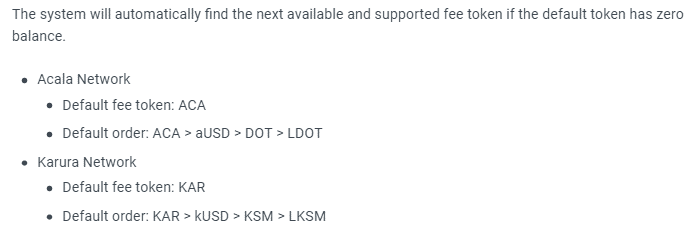

If your selected token has no balance, the platform will automatically find the next suitable fee token.

What are the ways to trade on Acala Swap?

Traders can use the following steps to set up their portfolio on the DEX:

- Connect to the decentralized exchange with any one of the supported wallets

- Select the tokens you would like to swap or add liquidity to the available pairs

- Withdraw funds to your exchange whenever required

Customer support

Traders can only contact the developers with the helo of an email. There are no live chat or telephone lines available. A newsletter is available on the website for subscription purposes.

Should you trade with Acala Swap?

Acala Swap has the following pros and cons.

| Pros | Cons |

| High ROI liquid staking | No regulation |

| Open source code on GitHub | Lacks proper customer support |

| Limited wallets are available for connectivity |

Customer reviews

No customer reviews are available for Acal Swap on noted websites such as TrustPilot. The lack of user feedback shows that the general community has not tested or invested in the platform. Their Telegram channel hosts over 30000 members. However, the posting rights are limited to developers only.