- Bitcoin bounced back amid inflation jitters and El Salvador legal tender confirmation.

- Gold is struggling for direction near the crucial $1900 level ahead of the U.S. CPI data.

- The U.S. equities remain range-bound, waiting to see the FED response to CPI data.

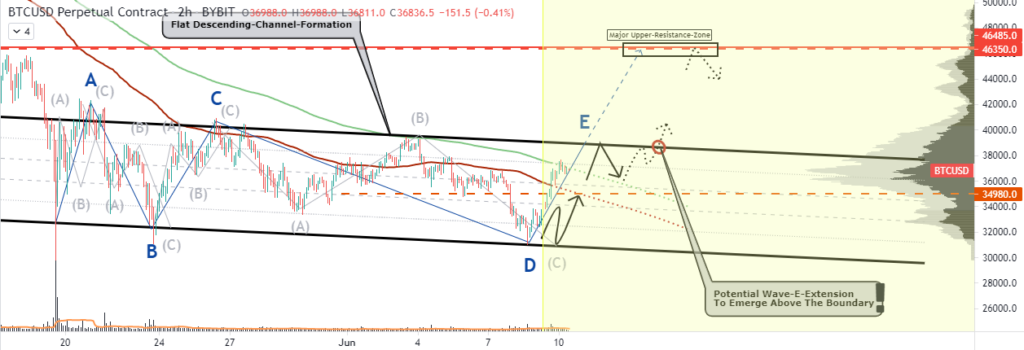

Mounting inflation and hopes of mass adoption following El Salvador’s approval of Bitcoin as a legal tender are the latest factors fuelling a bounce back in BTC/USD price. The flagship cryptocurrency turned bullish on Wednesday, rallying by more than 5% from lows of $32,000 and taking out the $36,000 resistance level.

While Bitcoin has turned bearish in recent weeks, the $30,000 has emerged as a critical support level preventing further selloff.

However, the recent bounce back faces strong resistance near the $40,000 level where bears are likely to come into play. A rally followed by a close above the $40,000 level should reaffirm the end of the selloff wave that had seen BTC/USD shed more than 50% in value from record highs.

Data from China showing that the producer price index rose 9% continues to fuel inflation, favoring higher BTC/USD prices. In recent months Bitcoin has emerged as a hedge against inflation.

El Salvador approving Bitcoin as a legal tender is another factor offering support for higher Bitcoin prices. Legislation mandating businesses to accept bitcoin payments is already fuelling hopes of widespread sovereign adoptions expected to support BTC/USD rally support.

Ethereum classic rally

Ethereum classic is another cryptocurrency benefiting from positive rhetoric in the broader cryptocurrency sector. ETC/USD has bounced off two and half weeks low as momentum around cryptos continues to build up after the recent selloff.

After the recent selloff, the $50 level has emerged as a critical support level offering support to higher ETC/USD prices. The pair needs to hold above this level to have any chance of powering high. ETC/USD is down by more than $60% from its record highs of $178 registered in May.

AUD/USD bounce back

The Australian dollar bounced back against the dollar in the forex market after coming under pressure late Wednesday. The AUD/USD pair was up by more than 0.5% early Wednesday morning as traders shrugged off the NAB Business Confidence Index data that slowed to 20 points from an estimate of 21 points.

Amid the slowdown, business activity in the country remains high, and the country has performed well in handling the pandemic. Economic recovery gathering momentum is one factor that supports the AUD, fuelling a rally in the AUD/USD pair.

The pair appears to have found support near the 0.7720 level, waiting to see if the upward momentum has what it takes to fuel a rally past the 0.7750 resistance level.

Focus ahead is on the U.S. CPI release, which will significantly impact the greenback and consequently influence the AUD/USD direction of trade.

Gold rally stalls

Gold is struggling for direction in the commodities market, having hit strong resistance levels above the $1900 an ounce level. XAU/USD has since retraced lower amid data showing open interest positions increased for the third day in a row by nearly 3,000 contracts. Additionally, the volume has shrunk by almost 31,000, signaling an unwillingness to buy at current highs.

XAU/USD has extended its slide below the $1890 level in response to rising open interest. The recent pullback faces strong support near the $1860 level.

Looking ahead, the focus is on the U.S. CPI data later in the day. The report is expected to shed more light on the Federal Reserve’s next policy path amid increased tapering expectations. The ECB indicating it could roll back tapering is another development that could weigh on gold prices.

The U.S. equities are range-bound

The U.S. equities were yet again on the receiving end on Wednesday, edging lower as the market awaits the CPI data on Thursday expected to provide clues on inflation. All three major indices reversed gains, with the Dow Jones Industrial Average dropping 0.44% to 34,447.14 and the S&P 500 dropping 7.71 points to 4,219.55. The NASDAQ was relatively flat at 13,911.75 after dropping by less than 0.1%.

All three indices are flirting with record highs but remain range-bound in the absence of a clear market catalyst. Thursday’s CPI report could be the catalyst to fuel a breakout from the current stalemate.