There isn’t much difference between digital assets and traditional ones like stocks and bonds when it comes to short-term trading. Listed here are some speculative approaches used for Bitcoin.

Using a trading bot

An automated trader or a trading bot can be built to perform several trades in a short period of time, which is known as high-frequency trading (HFT). This approach necessitates a thorough understanding of complex trading methods and computer programming languages.

While cryptocurrency trading bots do the actual trading, high-frequency traders don’t just sit back and let a computer program handle the entire process; they actively participate in it. Developing a trading strategy, creating a program to carry out that plan, and monitoring, backtesting, and updating the algorithms are all part of building a trading bot. Moreover, pre-built trading bots are ready to use, and users can purchase them from certain merchants.

A crypto trading robot can monitor the market around-the-clock, even while you’re sleeping, in order to find the best possibilities. To further enhance its performance, you can enable smart trade orders.

The ease with which traders may invest in the cryptocurrency market is one of the reasons automated trading is such a popular approach. You can go about your business as usual while the robot generates income for you.

Scalping

It is a short-term trading approach that a trader uses to gain frequent modest profits from little price movements every day. It is possible to accumulate a sizable sum of money over time by making even minor profits from individual trades. For instance, you can split your $10,000 trading capital to open 10 five-minute trade positions worth $1,000 each. Assuming 7 of your trades succeed and assuming each of your ten trades had a spread of $20, you’ll make a profit of (7 X $20)-(3 X $20)= $80 in just five minutes!

The volatile nature of the Bitcoin market makes scalping a popular way to trade. When it comes to risk management, scalpers frequently employ leverage and tight stop losses to open a large number of trades at once.

The primary goal here is to make as many trades as possible while minimizing losses. You don’t need to make a lot of money per transaction to be a successful trader.

If everything goes according to plan, the winning and losing sizes should be equal. You need to win a lot if you want to consistently turn a profit. It is possible to lose the majority of your trades while also gaining a few and still remain profitable.

This method is indeed very different from many other strategies. Typically, when traders utilize this approach, they avoid volatility because it is too unpredictable for them. One of the optimal conditions for a trader is a calm and quiet market with little or no activity.

Since there are few bids and offers, traders might profit from the gaps created by the thin market. On the one hand, they purchase, and on the other, they sell. One can always get out of a trade if something goes wrong. However, if you don’t have a lot of patience and discipline, this method isn’t for you.

Traders must also contend with automated trading systems if they wish to profit from scalping possibilities.

Buy the dip and HODL

The Bitcoin market is prone to media attention since most buyers lack market experience. When the news is good, people rush to acquire cryptocurrencies and vice versa. When the market is overvalued or undervalued, traders can use their experience and knowledge to get an advantage in the market.

Using this method, you don’t need any special software. There is a drawback to this approach in that it requires a long-term perspective on the market, which means that you can’t make quick money here as compared to scalping because time is crucial. A good example of how to look at it is to imagine that its value increases by 20% a week after purchasing Bitcoin. Even in such a short period of time, you will have made a sizable profit.

A significant drop in price is possible, however. In that case, you’ll incur losses. Essentially, most cryptocurrency traders who employ the HODL method make their investments while the price is extremely low and grab their profits when the price rises significantly. Also, traders that use long-term buy-and-hold strategies are less likely to engage in excessive trading. As a result, you’ll save a lot of money on your transaction fees.

Range trading

In financial terms, range trading refers to a price movement between high and low fixed price points. Crypto traders that engage in range trading take positions, both long and short, depending on where the price is in the range at any one time. Price movements outside of this range are seen as an indication that the market is about to face an unusual shift.

In order to enter a position manually, a trader will look to purchase at support and sell at resistance points. Alternatively, scalpers can use limit orders to buy cryptocurrency. There are times when a lower entry point within a favorable direction and at a support level is best. When the market is flat, scalpers can trade ranges.

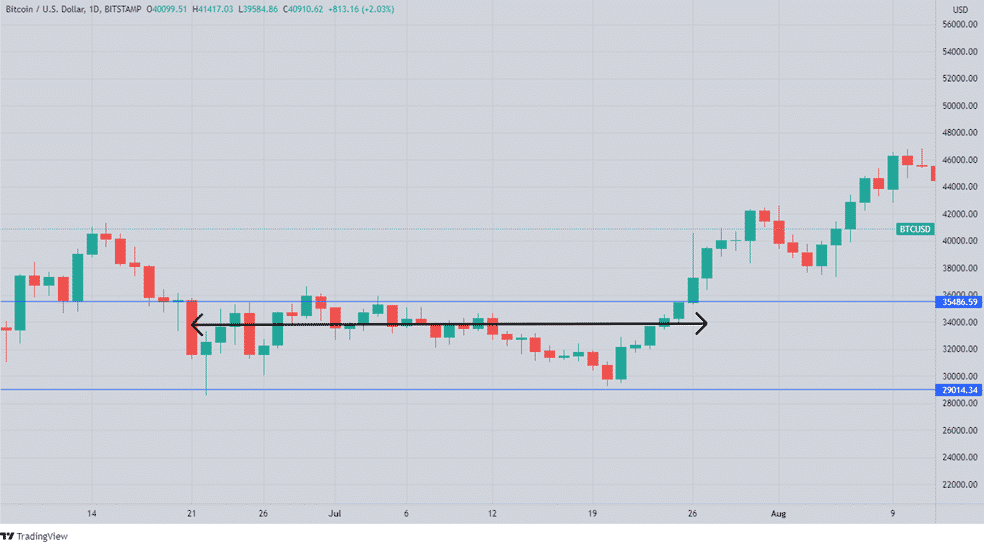

The chart below shows how the BTC price remains within a range of $29,014 and $35,486, as indicated by the black arrow. These are the areas of support and resistance, respectively. Therefore, you’d want to trade between these two levels. Based on this logic, you can buy at $29,014 and then sell at $35,486 to profit from range trading BTC. If you believe that BTCUSD will remain in this range for the foreseeable future, you will do it repeatedly.

However, if it breaks outside this band, it would signal that it’s time to place your entry and exit points outside the range.

Also, range traders should keep an eye out for overbought and oversold conditions. An overbought zone indicates that the market has satisfied buyers’ demand, and the asset is likely to fall in price. It’s possible to identify these zones using the built-in stock chart indicators.

In summary

Creating a Bitcoin trading strategy that succeeds most of the time is not a simple undertaking. Every trading strategy needs tracking and monitoring to determine whether it is working. As there are so many options, it can be difficult to choose one strategy. However, traders have the opportunity to invest their time and effort in learning about the market they aim to trade in. It’s also important to remember that we don’t always have to use the same strategies. However, because of the abundance of crypto market data, we can revise and update our Bitcoin trading strategies from time to time.