There are plenty of currencies and tokens vying for your consideration in the cryptocurrency market. Choosing which assets to include in your portfolio can be a difficult decision for an investor. Regardless of your personal risk tolerance and financial requirements, you can always find a strategy to preserve your investments while also increasing your long-term profits.

The core principles of asset allocation and diversification still apply when you establish a healthy cryptocurrency portfolio, even though it can be a wild ride.

What is a cryptocurrency portfolio?

There are an estimated 15,000 cryptocurrencies in circulation. A cryptocurrency portfolio is a collection of cryptocurrencies that an investor or trader owns and that they use for investment or trading purposes. Also, it is common for portfolios to include cryptocurrencies, as well as other types of assets. When considering digital assets, it’s critical to first create an evaluation framework and then use it to develop a portfolio.

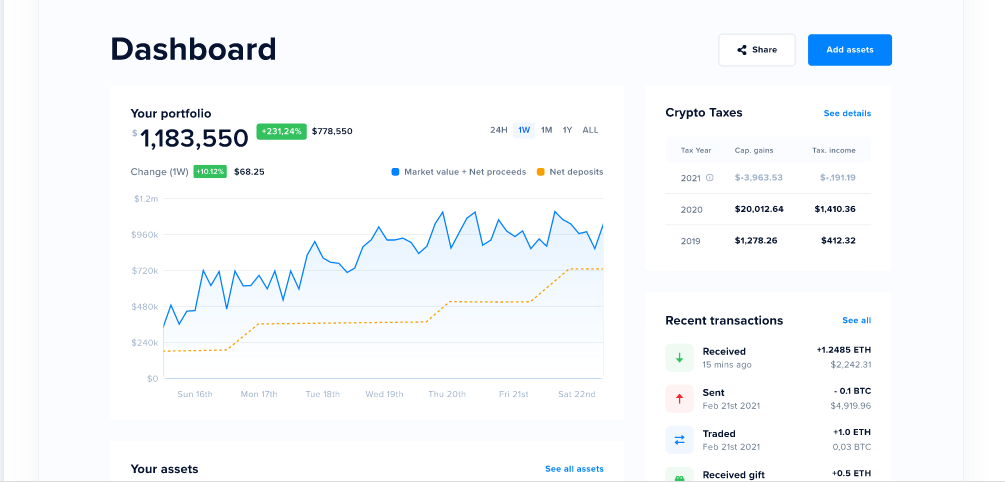

You can keep track of your holdings and profits using a spreadsheet or specialized tools and software. The use of a portfolio tracker is highly recommended.

Building a cryptocurrency portfolio

Assess the potential for asset growth

To evaluate a crypto asset’s growth prospects, utilize the following checklist:

- Market function: Determine whether the asset has a functional niche and/or a unique functionality in the blockchain market before investing. More users and investors will be interested in the coin if it can solve a more significant issue.

- Adoption rate: Get a sense of how many people are interested in a particular asset and how big that community is. Examine their strength and the extent to which they will contribute to the asset’s development in the future.

- Incentives and platform governance: Make sure that the asset you choose has suitable incentives and a well-defined governance structure in place. Inquire about the project’s incentives, mining support, and how the currencies are generated.

Diversifying and allocating assets in your portfolio

The term “asset allocation” refers to the practice of diversifying one’s investments across several asset types. The dispersion of your funds among various assets or sectors is what we mean by the term “diversification.” By utilizing one of these methods, you’ll be lowering your overall risk.

Spreading your money over a variety of assets has both advantages and disadvantages, as is true for all investors. You can reduce risk and the adverse effects of volatility by having a well-diversified portfolio. You can counter losses with profits and maintain your current position. With more coins in your portfolio, you have more chances to profit.

All cryptocurrencies are technically part of the same class. The advantage of diversification in a cryptocurrency portfolio is that it allows you to hold a variety of assets with varying objectives and use cases. For instance, if you wanted to allocate your portfolio, you could do so by putting 30% BTC, 30% stablecoins, 20% NFTs, and 20% altcoins in it.

There are advantages and disadvantages to both sides of the argument when it comes to diversifying your portfolio. However, it is generally agreed that a certain amount of diversification is advantageous.

Types of crypto

- Major crypto: Bitcoin (BTC) and Ether (ETH) are excellent assets for new crypto investors to begin (ETH). Bitcoin is the crypto world’s gold standard, and it has the advantage of being the first to market, which has made it well-established. As a store of value, it’s the most popular digital currency in the market, and it has the most partners and vendors. On the other hand, because of the concept of “smart contracts” that Ethereum has incorporated, a great deal of new functionality is possible. You may also want to include Binance Coin, Cardano, and Solana in this category.

Coins other than Bitcoin and Ethereum (altcoins) increase in value more rapidly during times of bullish market conditions, but they also have a tendency to plummet in value. Most altcoins can go bust at any time and without warning. As tempting as it may be to invest in random cryptocurrencies, you must be aware of the hazards involved.

- Stablecoins: Stablecoins are designed to mimic the value of an underlying item, such as a fiat currency or a commodity. Being able to count on investment to hold its value in an unpredictable market like the crypto one is a plus. If the stablecoin is pegged to anything outside of the crypto ecosystem, a downturn in the crypto market shouldn’t have an impact on the stablecoin.

- Utility tokens: These tokens are used to unlock service or item. When using decentralized applications, you can also utilize them to pay transaction fees (DApps).

- Payment tokens: When digital coins first emerged, the majority of their initiatives were methods for transferring value. For example, Bitcoin and Ripple can be used to make payments directly. Especially in light of the growing use of cryptocurrency as a form of payment around the world, they are a vital asset class.

- Privacy coins: There are a number of cryptocurrencies that are geared toward enhancing the secrecy of transactions. Every one of them is a little bit different in how it goes about its business. Nonetheless, one of them should be in your portfolio because privacy is a major selling point for using cryptocurrencies. Coins like Monero, Secret, and ZCash are examples of this type of asset.

- Governance tokens: It is possible to obtain voting power on projects and even a piece of the profits by owning governance tokens. It is very likely that you will encounter these tokens on DeFi systems.

Carry out your own research

Don’t rely only on the counsel of others when it comes to investing your money. Volatile and dynamic, the crypto market is an exciting place to be. As a result, a view that holds true today about a certain asset may not be accurate in a month’s time.

If necessary, rebalance your investments

In the dynamic crypto market, your decisions should adapt as the circumstances change.

In summary

Overall, cryptocurrencies are an emerging asset class that has the potential to offer high yields at the expense of substantial downside risk. Your crypto capital is the amount of money you’re willing to risk losing altogether. By limiting your exposure to riskier assets, you will not be harmed when volatility hits on the downside.

Cryptocurrency’s risks and volatility are mostly due to the fact that it has only been around for a short period of time compared to other financial instruments such as stocks and bonds. If you’re familiar with cryptocurrency, you may approach your portfolio’s asset allocation and diversification, in the same manner, you would need a regular one.