Saros Finance is a decentralized exchange. It allows traders to swap, farm, and stake their cryptocurrencies. The exchange uses a non-custodial wallet to add/remove funds from the DEX and makes all the transactions public. Traders can witness the top tokens and pools at the not-so-user-friendly interface of Saros. Let us go through all the broker features to see if our funds are safe for the long term.

Saros Finance overview

Saros Finance is built upon three major blocks: SarosSwap (AMM), SarosFarm, and SarosStake. The main features of the DEX are:

- No need for permission to create a liquidity pool

- User-friendly interface

- Low transaction fees

- Available on multiple social media channels

What countries does Saros Finance support buying and selling in?

There are no restrictions on any country while trading on the Saros Finance. Due to its decentralized nature, the broker does not need to comply with KYC policies. Traders worldwide can participate in the trading activity on the DEX.

How does Saros Finance work?

After connecting the respective wallet with the exchange, traders can swap tokens, farm, and add liquidity on Saros Finance. Incentives are given in the form of Airdrops, commissions, and gamification.

What can you buy on Saros Finance?

Some of the significant tokens available at Saros Finance are:

- USDT

- ORCA

- POLE

- MEAN

- PRT

- BTC

- WETH

- USH

- BNB

- AVAX

- LINK

Is Saros Finance safe?

There is no regulatory authority presiding over the activities of Saros Finance. The lack of proper regulation can put your funds at risk. The DEX exchanges are subjected to hacks and phishing attacks, resulting in the loss of equity.

Saros Finance fees, compatible wallets, and transactions

Saros Finance only supports coin 98 extension as a wallet. The wallet is available as an extension on google chrome. Besides this coin 98 mobile application can also be used to add funds.

The DEX charges 0.25% of the total swap amount for liquidity provider awards. Networks fees incur while concluding transactions with SarosFarm. The developers are not clear on the recurring gas costs.

What are the ways to trade on Saros Finance?

Traders can use the following steps to start trading on Saros Finance:

- Connect with the help of the supported wallets to the DEX

- Select your choice of investment, i.e., swap, farming, or liquidity pools

- Invest in the respective areas and withdraw cash as needed

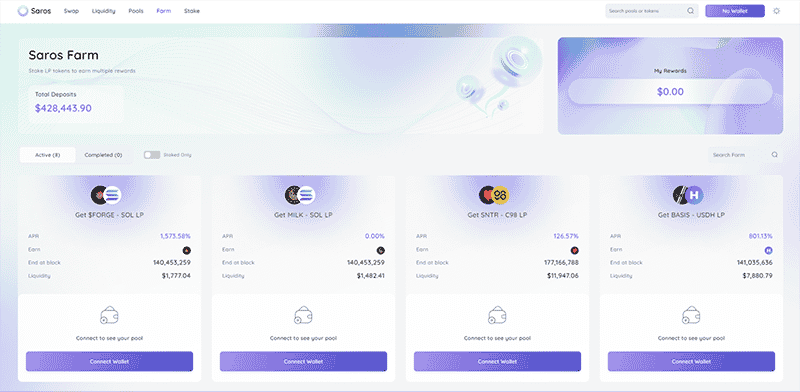

Currently, the platform supports liquidity addition, swapping funds, and staking SAROS tokens to earn rewards. The DEX is built on Solana. A total of eight liquidity farms are available as of now, with APR ranging from 20 to 1500%.

Customer support

There are absolutely no ways to contact the developers. The developers share a link to their Telegram channel; however, the admin retains the commenting rights. The lack of proper customer support can leave beginners on a needless quest to get answers.

Should you trade with Saros Finance?

Saros Finance has the following pros and cons.

| Pros | Cons |

| Multiple cryptocurrencies are available | Only a single wallet available for connectivity |

| Lacks proper customer support | |

| No information on the developers |

Customer reviews

There are no customer reviews for Saros Finance on noted platforms like TrustPilot. The lack of user feedback leads us to believe traders may not have used decentralized exchange.