Trisolaris is a decentralized exchange that is popular among users of NEAR’s Aurora engine. It provides high-speed trading solutions that cost much less than similar services based on Ethereum or Ethereum L2 solutions.

Trisolaris Exchange overview

Let’s talk about the service features:

- TRI token was announced by the TriSolaris ecosystem as a native token.

- There is the total supply released – 500,000,000 tokens.

- The period of emission will be 36 months.

- 70% of them will be owned by the community.

- 15% will be a part of treasure for “future strategic partnership, investors, and more.”

- 15% belongs to the developers team.

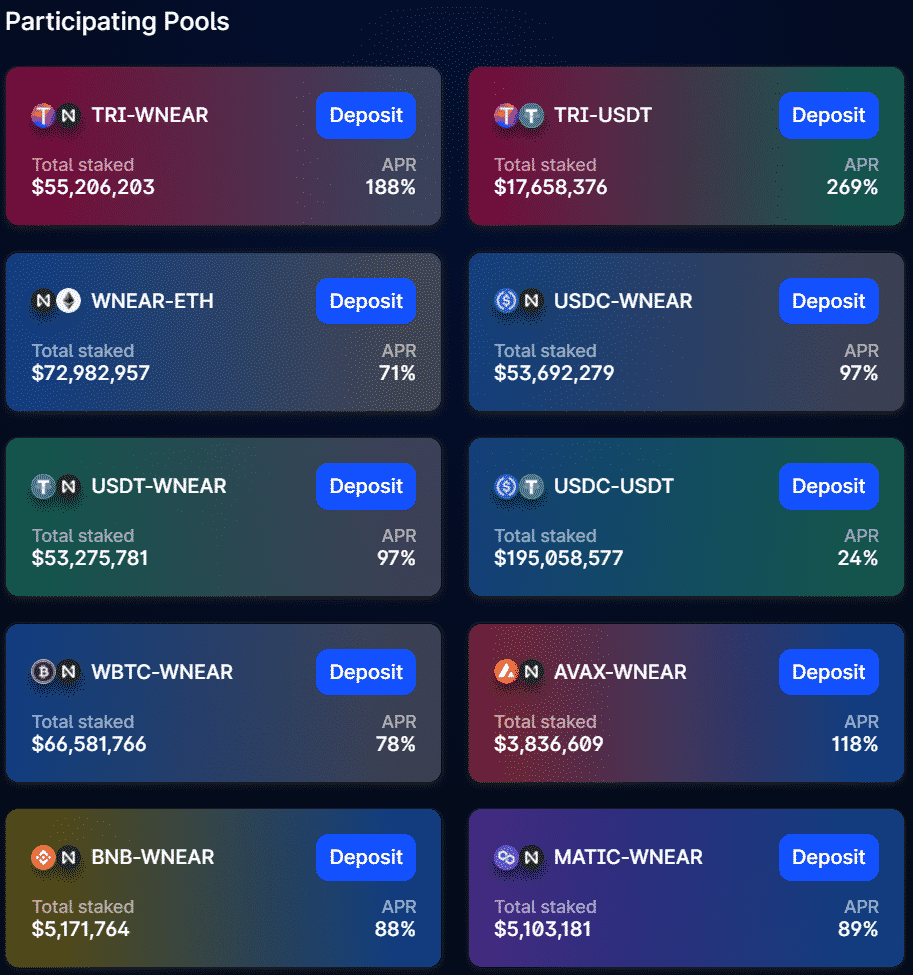

- Pools include various tokens allowed: ETH, USDT, USDC, WBTC, wNEAR.

- TRI holders can vote for changes and proposals.

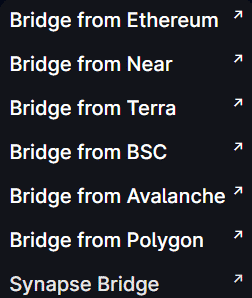

- We can bring our tokens from the following blockchains Ethereum, Near, Terra, BSC, Avalanche, Polygon, and Synapse.

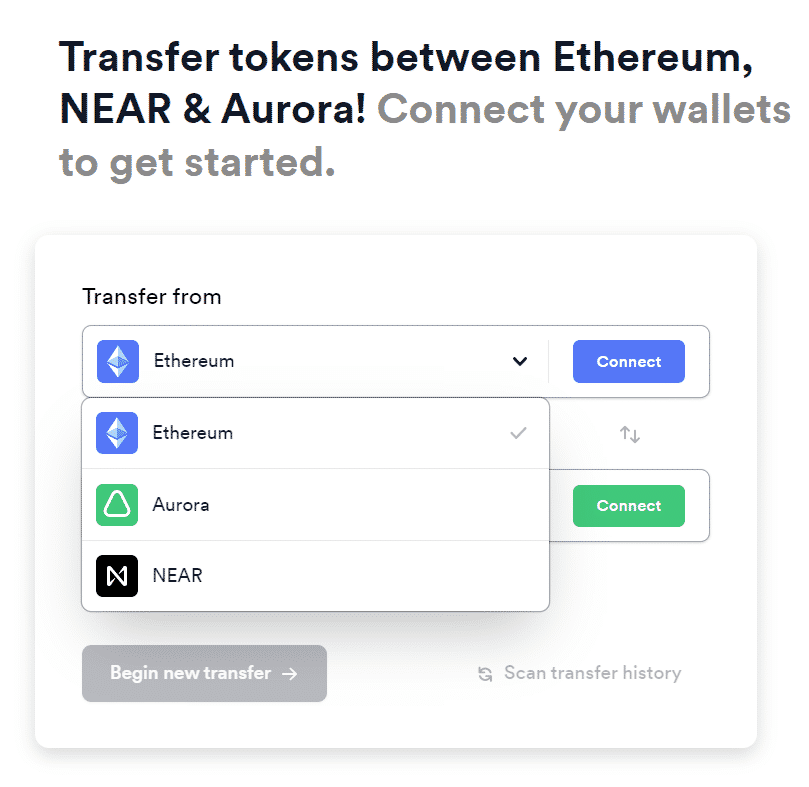

- We can transfer our funds between wallets with Ethereum, NEAR, and AURORA coins.

How does Trisolaris work?

The site doesn’t include any information about the service.

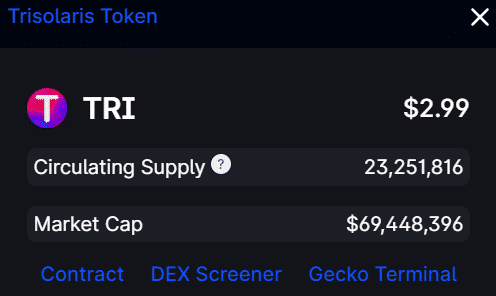

The current price is $2.99 for a coin. We have calculated supply at 23,251,816 coins. The current market cap amounts to $69,448,396.

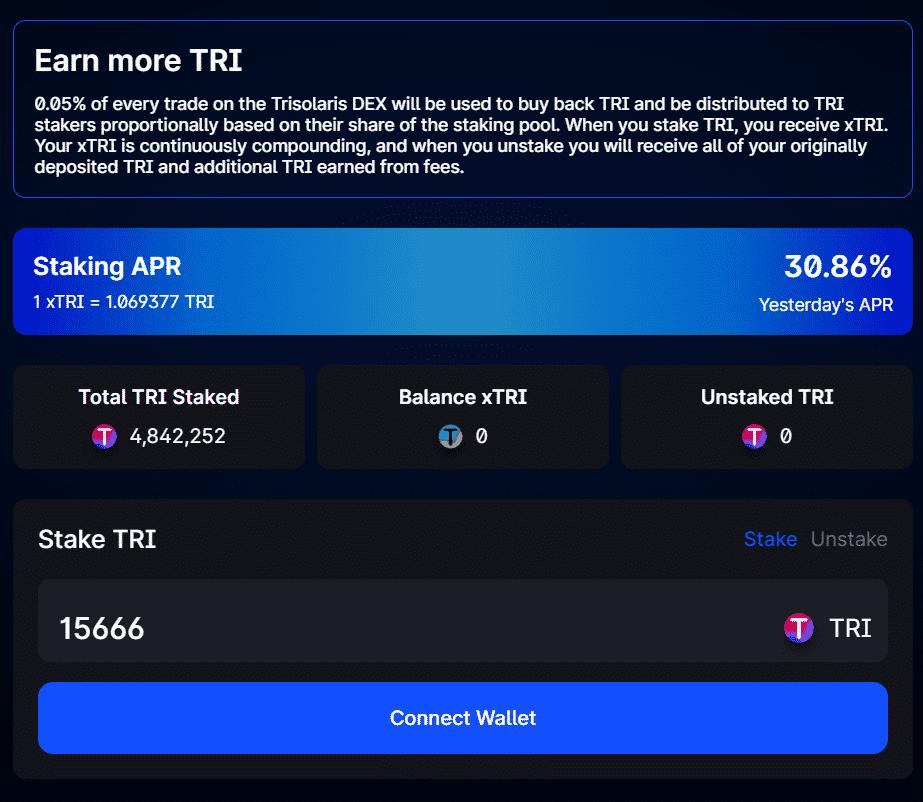

We can check how many TRIs are already stacked. The staking APR is 30.86%. So, the devs pay 0.05% from every trade to buy out TRI tokens and share them among stackers proportionally.

What can you buy on Trisolaris?

- We have to connect our wallet with Trisolaris.

- We should choose tokens to stack.

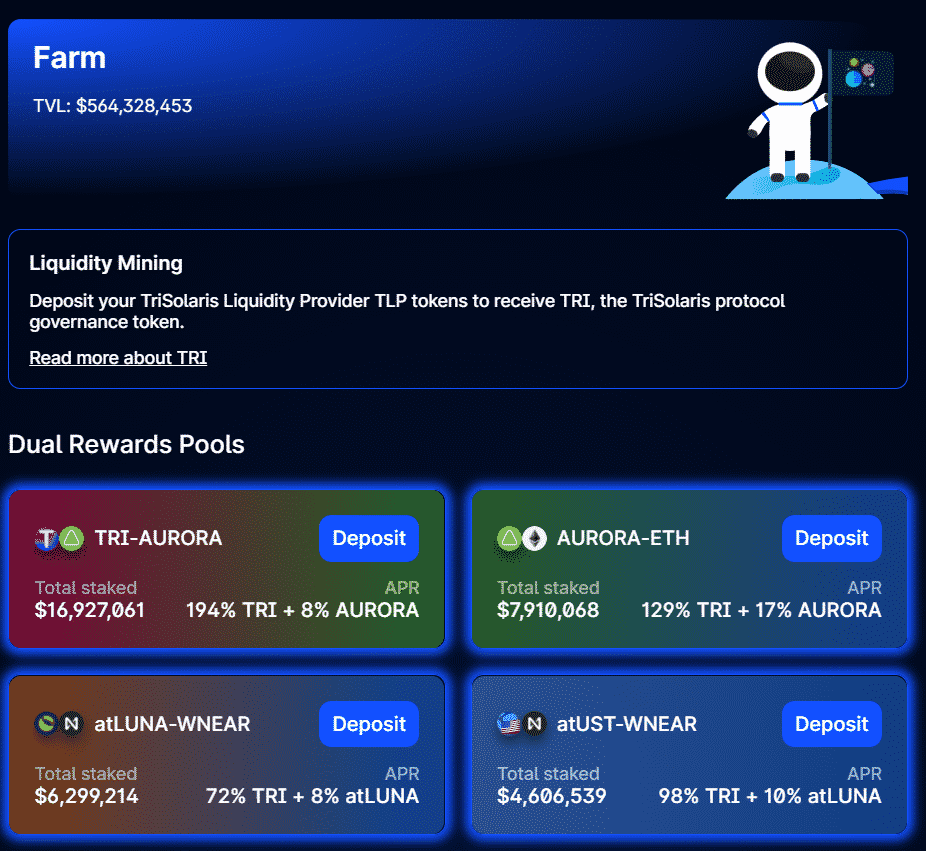

- So, we look at the liquidity mining feature.

- The deposit should be in Trisolaris Liquidity Provider TLP tokens.

- There are various, mentioned before, pools that have different profitability.

- TRI-AUTORA has 194%TRI + 8% AURORA APR.

- AURORA-ETH has 129%TRI + 17% AURORA APR.

Is Trisolaris safe?

The platform was developed on the Near blockchain. That is pretty safe. We have no mentions that those pools were robbed or any other fraudulent activities occurred.

How to use Trisolaris?

We can transfer our funds from three blockchains: Ethereum, Aurora, and NEAR.

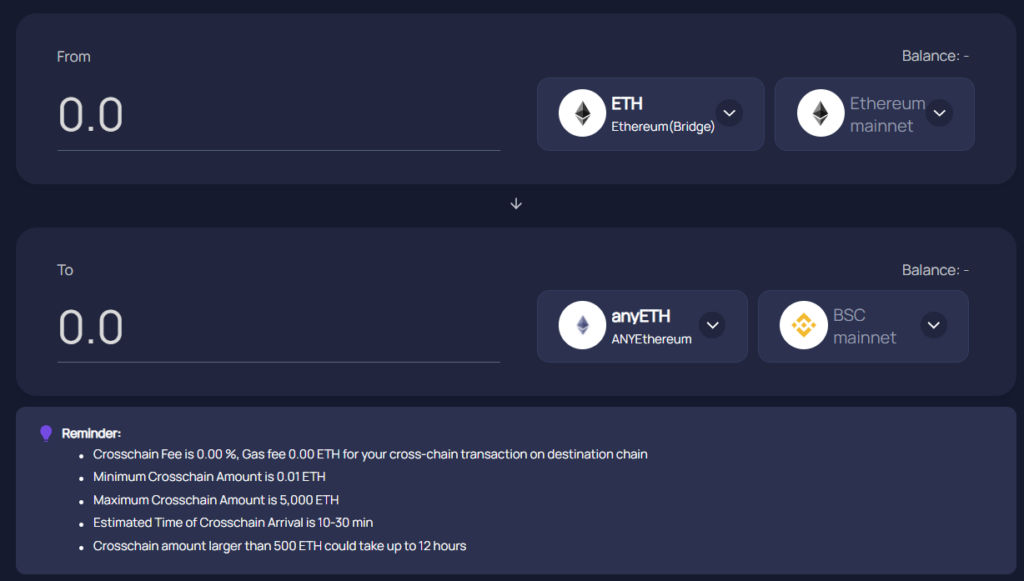

There are many bridges available: from Ethereum, Near, Terra, BSC, Avalanche, Polygon, and Synapse.

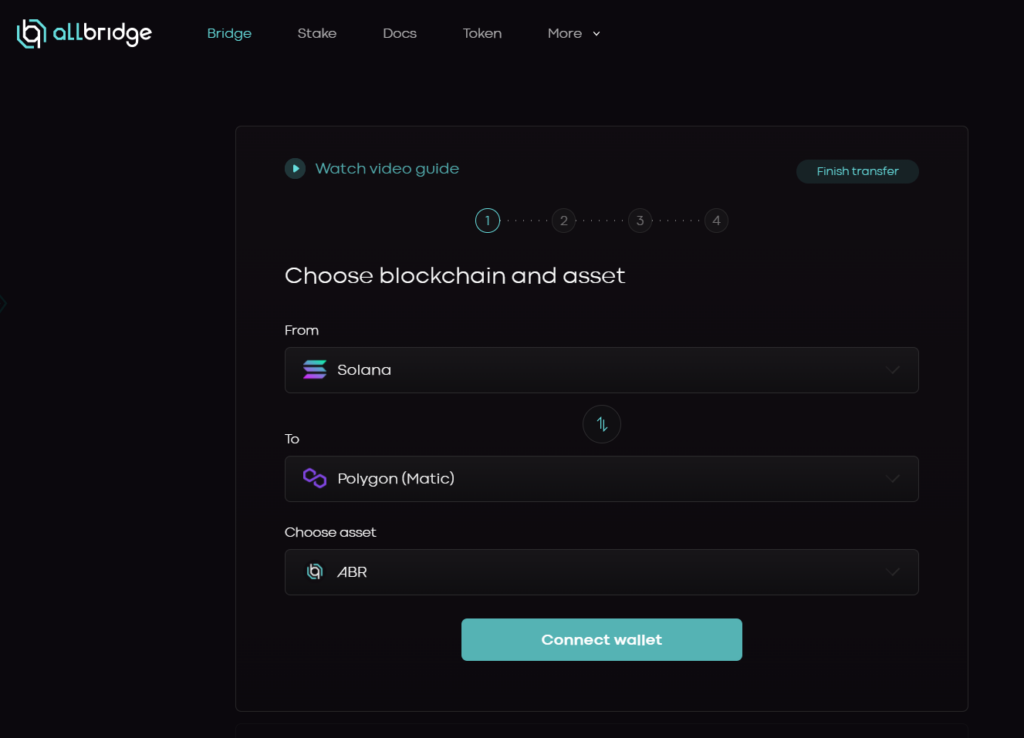

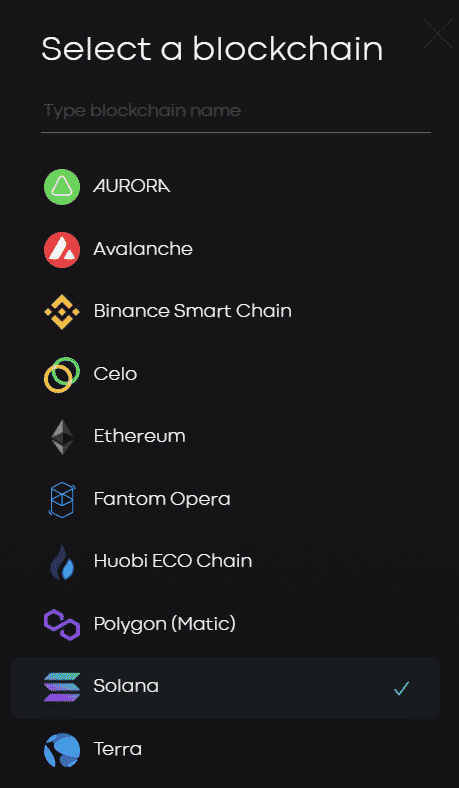

We can see the allbridge customization to proceed our tokens to the pools.

- There’s an exchange service available.

Trisolaris fees, compatible wallets, and transactions

- The developers claimed that 0.3% will be paid for all liquidity providers.

- Liquidity mining was started only several months ago on November 16, 2021.

- The devs deployed several more pools: wNEAR-AVAX, wNEAR-MATIC, and wNEAR-BNB.

- The Near blockchain decreases high fees of Ethereum and increases executing speed.

- The devs want to provide liquidity and swap to any ERC20 and liquidity mining investment.

What are the ways to trade on Trisolaris ?

We can stack, and participate in pools. Tokens can be traded on other trading platforms.

Customer support

We have an average support when our messages get answered within 6-15 hours. The project is new, so the support can be not the best one. It’s okay.

Should you trade with Trisolaris?

Trisolaris summary

Trisolaris summaryPros

- Near/Aurora based project

- Zero fees within Aurora

- Good yield profitability

- Various pools with different conditions are available

Cons

- Lack of people feedback

- The project is just several months old