KnightSwap is described as the finest decentralized exchange that runs on the Binance Smart Chain. It is created to conduct reliable and feasible yields while offering the highest quality DeFi experience. The main goal is to offer a synergistic ecosystem that can assist investors to build tools for accelerating wealth. The DEX was launched in November, 2021, and by March this year, it has surpassed the 200 million TVL.

KnightSwap overview

Here are the key features you will find on the DEX:

- Citadel

This is a special section within the exchange that makes it possible for you to stake tokens with its partner (Wolf Den) so as to earn other assets.

- Castle vaults

These vaults enable you to automatically harvest and sell rewards, purchase more tokens, and reinvest tokens on a continuous basis.

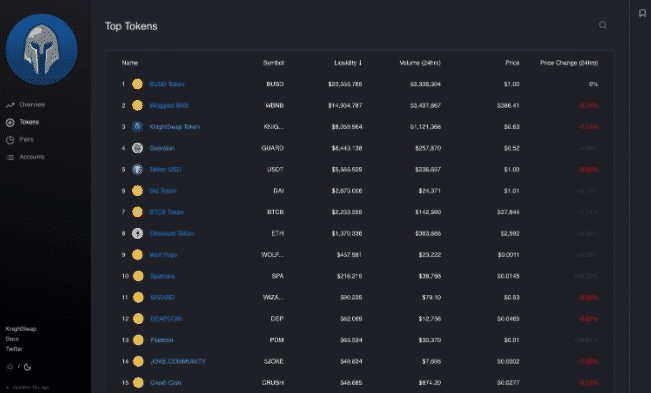

- Info and analytics

The devs offer comprehensive analytics for free, so you can follow and see how the platform and your portfolio grow.

- Initial Wizard Offerings (IWO)

This feature allows investors to be exposed to new projects early.

How does KnightSwap work?

You can engage in the following activities within the ecosystem:

- Trade

- Play games

- Yield farm

- Discover NFTs

- Create a liquidity pool

- Single stake in pools and raids

What can you buy on KnightSwap?

Here is a list of some of the assets you can transact on the platform:

- BNB

- DSG

- GUARD

- BTCB

- DUST

- JOKE

- BUSD

- ETH

- KNIGHT

- CRUSH

- FINS

- LIBERO

- DAI

- FORGE

- MetaFish

The devs claim that they have over 40 actively traded tokens with over 88 million in liquidity.

Is KnightSwap safe?

KnightSwap claims to take the safety and security of your investment very seriously. That’s why it lists and describes the precautions you can take to protect your account against scammers. As such, you are advised to use quality anti-virus software, never to share your private keys or seed phrases with anyone, and not to store them on your devices. Furthermore, it is vital that you disconnect your wallets from sites you are not using anymore and use 2FA for access to exchanges.

KnightSwap fees, compatible wallets, and transactions

The DEX works with a number of wallets, including Metamask, TrustWallet, MathWallet, TokenPocket, WalletConnect, and Binance Chain Wallet. Each time you engage in a trade, the platform will prompt you to pay a 0.2% trading fee. From this fee, 0.17% is taken back to liquidity pools as a reward for those offering liquidity, while 0.03% goes to the KnightSwap Treasury. On the other hand, you will earn that fee by providing liquidity.

What are the ways to trade on KnightSwap?

KnightSwap offers a wide range of trading options, which we have described below:

- Trade

This De-Fi offers you a chance to instantly swap tokens without registering for an account. All that is required from you is to link your wallet and begin trading.

- Provide liquidity

Offering liquidity on your exchange enables you to earn fees from other traders. The provision of liquidity also gives you access to the yield farm with your chosen liquidity pairs so long as the project has a farm with KnightSwap.

- Yield farming

Farming is only allowed when you add liquidity to the liquidity pool and receive an LP token, which you can deposit into the Farm to begin earning $KNIGHT tokens. The LP tokens will also earn interest through trading fees.

- Staking

This entails using $KNIGHT to earn more $KNIGHT tokens or obtaining partner tokens within the liquidity pools.

Customer support

Customer support is available in several forms. For instance, the platform features a Wolf Den that handles all of the educational content in this ecosystem. It consists of various articles that cover topics that relate to KnightSwap. FAQs and Troubleshooting, as well as step-by-step guides, are also present to help you navigate the platform with much ease. Last but not least, you can contact the support team with your questions via Telegram and receive the assistance you need.

Should you trade with KnightSwap?

KnightSwap summary

KnightSwap summaryPros

- Supports a big number of tokens that are exchangeable

- Doesn’t require you to have an account to trade

- Offers info and analytics tool

- Many trading options are available

Cons

- Liquidity provision carries the risk of impermanent loss