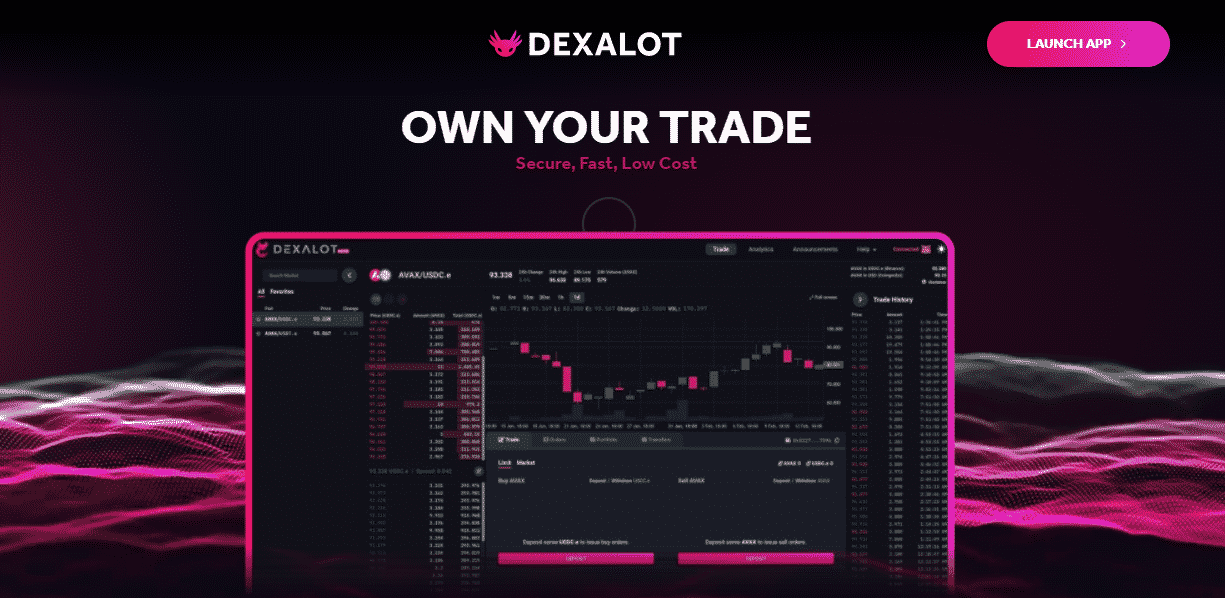

Dexalot is an innovative decentralized exchange that uses on-chain Central Limit Order Books. It assures users of secure, quick, and low-cost trading. This platform was formed to change the centralized exchange function via its decentralized on-chain application. The DEX was launched in the third quarter of 2021. Unfortunately, the vendor does not provide info on the company such as its location, phone number, etc.

Dexalot overview

Important features of the DEX that make it competitive as per the vendor are:

- The DEX has high transactional throughput with a 1 to 2-second finality.

- It does not need any intermediaries, just your crypto wallet for near-instant settlement.

- Low fee rates help users to increase their returns.

- The platform is built on the Avalanche blockchain which is the fastest smart contracts platform which has the AVAX token as its native token.

- ALOT is the native token of the platform.

- Supported coins include Avax, Dexalot token, Snail Trail, and USD Coin which are some of the top tokens of the platform.

How does Dexalot work?

The DEX allows for all the following:

- Transfer funds from your wallet to the on-chain portfolio after paying the network fees in AVAX

- A minimum total is defined for an order per trade pair. Your order should exceed the minimum to get accepted in the order book

- When you have sufficient asset balance via the selling of AVAX, you can trade in other trade pairs

- Two types of orders are supported by the platform:

- A limit order which is filled if the order book already has a maker order available at a similar or better price.

- A market order is an order that is automatically matched with the best ask or bid in the order book.

What can you buy on Dexalot?

The DEX works on the Avalanche C-Chain. You can trade the following assets or tokens on the platform:

- Avax

- Dexalot Token

- Snail Trail

- USD coin

- LostToken

- TetherUSD

- DegisToken

Is Dexalot safe?

As per the vendor, the platform uses well-audited libraries of OpenZeppelin to build on at the smart contracts level. Two private security audits and three public security audits by Hacken were also performed along with extensive infrastructure hardening to enhance the resilience of the platform. The platform also uses multisignature for security.

Dexalot fees, compatible wallets, and transactions

It supports the MetaMask, Rabby, Coinbase, and WalletConnect wallets. The fee structure for the DEX is as follows:

- For a limit order, the maker fee is payable when an order book entry occurs and until a taker order hits it. Taker orders that match with other orders in the order book will pay gas fees by correlating with the orders they fill.

- Network fees need to be paid in AVAX so you need to have sufficient AVAX in your wallet to execute the orders.

- The avalanche chain has dynamic fees which may increase or decrease according to the usage of the network.

What are the ways to trade on Dexalot?

Some of the important trading options on the DEX are:

- The Dexalot token is not only stakeable but also delegatable by validators and delegators to secure subnet and drive better governance.

- Dexalot token will work as the main currency for gas payments when the token moves to its subnet.

- The token is also used as an incentive to promote the platform and incentivize users on using the token.

- Users can trade ERC20 tokens supported by the C-chain against the native currency AVAX.

- Users can trade supported ERC20 tokens with other similar tokens.

Customer support

For support, links to social media pages on Twitter, Telegram, Discord, YouTube, Github, and Medium are provided. An FAQ section, tutorials, and a litepaper are also present.

Should you trade with Dexalot?

Dexalot summary

Dexalot summaryPros

- Operates on the C-chain of Avalanche which reduces slippage and risk

- FAQs, Tutorials, and blog support

Cons

- Fairly new platform with very limited features

- Limited number of supported currencies and wallets

- The fee structure is complicated