As a crypto trading app, Stoic assures high returns with its automated trading system. Cindicator Capital, a hedge fund company, is behind the development of Stoic. Launched in 2015, the fintech company develops predictive analytics by combining machine learning and collective intelligence technology.

Several of the analytical products of Cindicator are accessible via more than 300,000 Bloomberg terminals that various hedge funds and institutions use. As per the developer, the ATS is highly profitable and has generated over 991% starting from March 2020 up to February 2021. Other than an email address for support, there are no other contact details found on the site.

Stoic Offering

Our analysis of this crypto trading tool reveals that over the past year the automated software has generated high profits and added on more than 2,832 users. Some of the key feature highlights of the crypto trading robot include:

- The AI crypto platform ensures your crypto trading is on autopilot

- Forecasts from more than 163,000 analysts are processed by the Cindicator’s AI engine for creating the indicators used in the trading strategy

- Funds can be withdrawn whenever you want unlike the regular fiat currency trading

- The minimum deposit needed for starting trading is $1000

- While the bot does not charge a performance fee, a 5% annual management fee is charged.

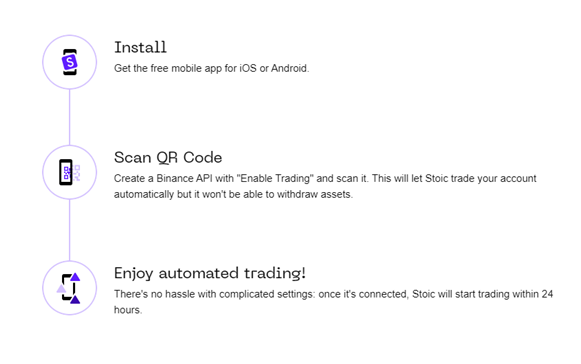

A very simple trading process is involved when you use Stoic. You need to first install the mobile app which is free for both Android and iOS versions. The next step is creating the Binance API and scanning it. With the simple settings, you can begin trading in 24 hours. Stoic will do the trading for you but it does not have access to withdraw funds from your account.

The Idea Behind Stoic

Created by the team at Cindicator Capital, the main concept of Stoic is providing efficient automated trading software focused on cryptocurrencies. As per the vendor, the main strategy is based on indicators formed by forecasts made by numerous crypto analysts with the help of the artificial intelligence-powered processes at Cindicator. The strategy rebalances the leading 20 crypto assets with the help of the forecasts from analysts.

The Core Team

Mike Brusov and Yuri Lobyntsev are the co-founders of Cindicator. The team here includes 30 members working remotely and on-site from different parts of the world. As per the company info, the team consists of members skilled in various spheres including data science, finances, quant trading, math, and more.

Safety of Stoic and the Network

When it comes to crypto trading you need to ensure the ATS you use is secure and safe. As per the vendor, you need not worry about the safety of your private keys as the crypto bot uses unparalleled security measures. Your assets will remain safe on the account you have created on Binance which is the largest and safest crypto exchange.

24/7 Monitoring

The crypto app offers 24/7 portfolio monitoring and withdrawal of funds. There are no elaborate processes to go through to withdraw your money. If you want to cash out your profits or change your mind about the investment, the app offers an easy and hassle-free process without any lockups. In addition to the full-time access, you can get round-the-clock updates on the vital crypto news events enabling you to manage your portfolio efficiently.

Client Testimonials

A few client testimonials are found on the official site. Here is a screenshot of the reviews:

From the above reviews, we could see that the crypto robot is performing well as one user refers to the reduced risk in trading crypt due to the bot. But we are a bit skeptical about the reviews as there is a high chance of these testimonials being manipulated. With no reviews from users on reputed third-party review sites, it is clear that the ATS is fairly new and not a popular name among crypto traders.

Is Stoic a Legit Investment Service?

It is important that a crypto robot be a genuine platform that you can rely on.

Our Verdict

Our VerdictPros

- Developed by Cindicator Capital, a reputed hedge fund company

- 24/7 monitoring

Cons

- The strategy explanation is vague

- No performance results are posted

- Lacks legitimate user reviews