HodlBot is an automated trading bot for cryptocurrencies that promises customized features for users. Creation of customized portfolios, market indexing, and rebalancing of cryptocurrency portfolios are some of the features this crypto trading bot offers.

The company boasts a trading volume of over $50 Million and over 400K transactions. There is no info present on the founding year, the vendor address, and phone number. The lack of transparency raises a red flag. For customer support, the vendor offers an email address and Telegram group access. No live chat feature is present.

HodlBot offering

From our analysis of the official site of this crypto service, here are some of the factors that the company concentrates on:

- A single-click diversification of the investment portfolio ensures reduced risk and better returns. The HODL indices are created for users who prefer the diversification of their investment portfolio.

- Users can create customized portfolios using advanced market metrics. The creation of crypto indices is also possible with the index made of popular N coins.

- With the rebalancing feature, instead of drifting away due to market shifts, you can keep your portfolio on track and also save time.

- Some of the customization settings the vendor offers include altering the rebalancing frequency, asset liquidation, and blacklisting coins you do not want to trade.

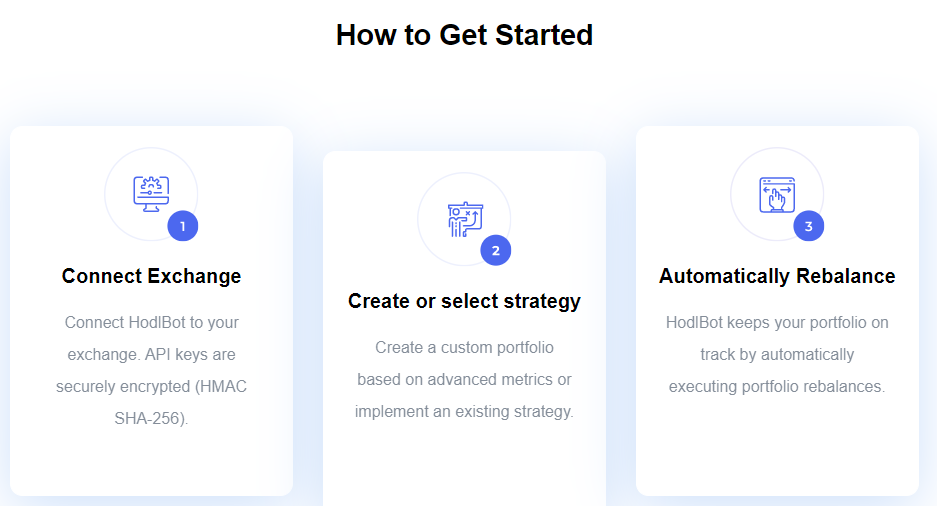

To set up an account here you will require a Binance or Kraken account and a cryptocurrency value of $200 as a deposit. The service uses an API for connecting your account with the exchange. For market indexing, you can choose from the available strategies like HODL30, HODL10, and more. Users have the option to create their cryptocurrency portfolio or index.

The idea behind HodlBot

This crypto trading platform has been created to simplify the trading process. Direct interfacing with exchanges is not necessary for portfolio management when you use this platform. Instead of managing the trades individually, you can create your portfolio and manage it via this service. The software executes the trades using the exchange API and the exchanges complete the orders. Some of the exchanges this crypto service supports include Bittrex, Binance, Kucoin, and Kraken.

Team members

We could not find info related to the company, its developers, and other team members on the official site. The lack of details like founding year, location of the company, phone number, and more raises a red flag.

Safety of HodlBot and the network

For the safety of user API keys, the company claims to encrypt them cryptographically on the backend. Furthermore, users will have full control of their API keys via their exchange and the keys are for trading purposes and not for withdrawals.

The vendor recommends disabling trading permission for the API keys between the rebalancing periods for additional safety. We could not find other safety features the company uses to safeguard user info and transactions. The info that the company provides is not sufficient and raises our doubts about the reliability of the service.

Other notes

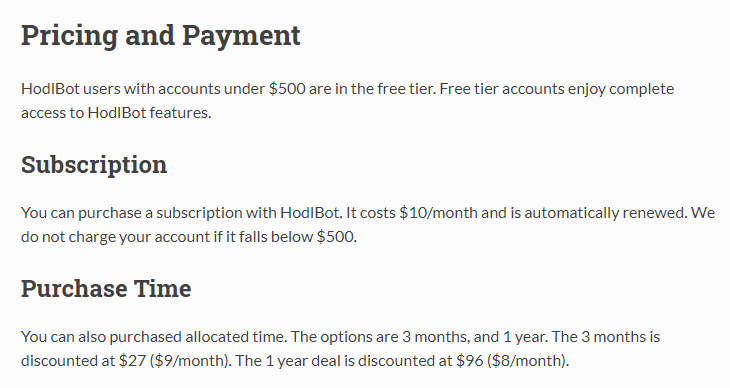

Under the pricing options, users who hold accounts of less than $500 come under the free tier and have access to the features of the company. A subscription package of $6 to $14 per month with automatic renewal is present for accounts over $500.

There are 3 months and one-year subscription packages at $9/month and $8/month. A free trial of 14 days is present for the service after which the subscription plans come into effect. There are no percentage fees for using the trading platform.

Client testimonials

We could not find user reviews for this company on trusted third-party sites like Trustpilot. While there are testimonials on the official site, we suspect they may be manipulated. The absence of user feedback indicates this is not a well-known platform.

Is HodlBot a legit investment service?

After evaluating the various aspects of this crypto trading platform, we find that it is not a genuine investment company. While there are a few positive factors, the downsides outnumber the benefits making this an unreliable company.

Our verdict

Our verdictPros

- Automated trading software

- Free 14-day trial

Cons

- No proven track record

- Lack of vendor transparency

- Does not support many exchanges