I believe that many friends have suffered varying degrees of losses in investment and trading this week, some in the gold market, some in cryptocurrencies, and foreign exchange! But what I want to talk about today are some special traders who have suffered heavy losses in the stock market! I have many friends and clients who have invested in the stock market. In the global stock market crash caused by tariffs this week, I talked to them about a problem. The whole world is plummeting, but the US dollar has not risen. Why does gold, as the first choice for safe havens, also have such a trend, and even achieve a double kill of long and short in one day!

I want to talk to you about my thoughts:

The market is not absolute, and there is no fixed pattern of ups and downs. Therefore, the judgment of the balance of ups and downs in the market is your magic weapon for winning. There is another word-desire! There is an Italian proverb: Let money be our loyal servant, otherwise, it will become a tyrannical master.

Shorts and longs can make money, but greed cannot. Do you control desire or does desire control you? I hope this sentence will be a mutual encouragement between us. Self-knowledge! It is important for people to know themselves. The truth is applicable to any industry, including the financial circle. If you don’t know yourself, you will make mistakes, and mistakes will make you sad. People need to breathe, and perfect trading is like breathing, which requires flexibility. You don’t have to trade in every wave. The secret to profitable trading is to execute simple rules, repeat simple things, and strictly enforce them for a long time.

Investment itself is not risky, but out-of-control investment is risky. Don’t use your luck to challenge the market. Luck does exist, but don’t expect it a second time if you encounter it once. Learn to stop loss. Stop loss is more important than stop profit, because at any time, capital preservation is the first priority, and profit is the second priority; the ultimate goal of stop loss is to preserve strength, improve capital utilization and efficiency, and avoid small mistakes from becoming big mistakes, or even lead to annihilation. Stop loss cannot avoid risks, but it can avoid greater unexpected risks, so stop loss skills are something that every investor should master. Stop loss is the lifeline of investment. Don’t lose more than you gain because of small losses. Remember one sentence, when you really know how to control risks, you will turn losses into profits.

Appendix: Gold Analysis

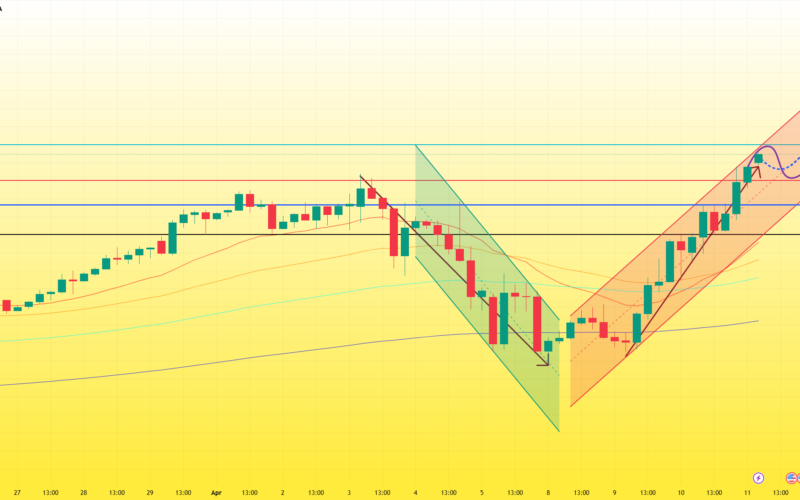

As I expected, the price of gold rebounded and strengthened in this trading day under the continuous stop-loss pattern, and returned to the middle track and above the short-term moving average. The bulls’ strength increased, and the moving averages turned into support again. The Bollinger Bands are also expected to open and extend upward, suggesting that the market will be optimistic about the future to strengthen again and refresh the historical high. Then the moving averages such as the middle track below will serve as bullish support, and the bullish operation will be carried out on dips.

From a technical perspective, gold broke through the upper track of the Bollinger Band at the daily level, and the support of the 4-hour chart moved up to 3150, maintaining a strong pattern in the short term. However, we need to be alert to the technical overbought callback risk and should not blindly chase highs. In terms of operation, it is recommended to go long after falling back to around 3150 and stabilizing, and the target is the 3185-3200 resistance zone; if it rebounds to above 3190 and encounters resistance, it can be lightly shorted. Overall, the global monetary easing expectations and risk aversion still dominate the market, and the medium- and long-term upward trend of gold has not changed.

In the 4-hour chart, 3130 is the key support. If it closes positive with support, it is expected to rise again. If it falls below, it may be adjusted sharply. However, the price is overbought and there is a need for a correction. It is expected that gold will remain strong, but be wary of a correction.

Investment strategy: buy near 3155-3175, target 3200