SYDNEY: Australia’s A$4.3 trillion (US$2.8 trillion) retirement system – long regarded as one of the world’s best-regulated savings pools – is emerging as a new frontier for crypto.

Coinbase Global Inc and OKX, two of the largest digital asset exchanges, are rolling out products aimed at steering pension money into cryptocurrencies, underscoring how digital assets are edging further into mainstream finance.

The initial focus is self-managed superannuation funds (SMSFs), which already make up about a quarter of Australia’s pension pool.

Unlike mainstream pensions, which have largely avoided crypto, these funds give individuals wide latitude over their investments.

“It does make sense that we’re probably seeing a bit more interest in crypto in the self-managed super fund space first,” said Fabian Bussoletti, technical manager at the SMSF Association.

“Perhaps the larger funds will catch up over time.”

Coinbase is nearing the launch of a dedicated SMSF service, with more than 500 investors on its waiting list, according to John O’Loghlen, the company’s Asia-Pacific managing director.

OKX launched a similar product in June, and demand has exceeded expectations, said Kate Cooper, chief executive of its Australian arm.

Crypto holdings in SMSFs remain modest: about A$1.7bil as of March, tax office data showed. But that’s a seven-fold increase since 2021.

Both exchanges are betting the trickle will accelerate, forcing regulators and institutional funds to confront an exposure they’ve so far resisted.

For now, AMP is the only major pension provider to disclose an investment in the asset class.

OKX’s product and Coinbase’s planned offering will also help investors establish SMSFs by referring them to third-party providers such as accountants and law firms.

While there’s no minimum balance required, ongoing administrative costs – including mandatory independent audits – mean SMSFs are typically only cost effective for larger accounts.

“This product will be more for buy-and-hold investors rather than active traders,” said O’Loghlen.

Coinbase, which flagged plans to target SMSFs last year, expects to roll out its service in the coming months.

A poll of those on its waiting list showed 80% intend to establish a new SMSF, with 77% planning to invest up to A$100,000 in digital assets, according to Coinbase.

The demand is generationally split, said O’Loghlen.

Baby Boomers, often nudged by children eager for exposure, are adding crypto to existing accounts.

Younger investors are opening SMSFs years earlier than past practice and skewing them heavily toward digital assets.

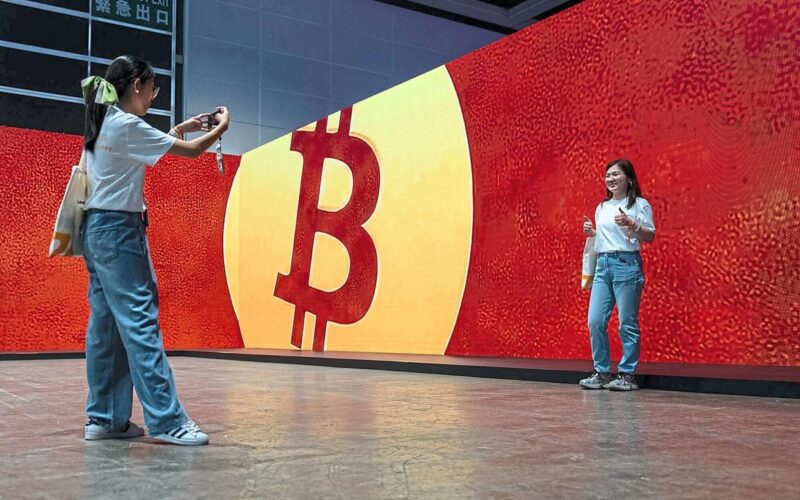

Bitcoin has surged almost 20% this year, hitting a record last month as president Donald Trump signed an executive order easing US retirement funds’ access to crypto.

Australia could prove a test case for digital assets’ shift from fringe bet to mainstream pension holding, but only if they can overcome entrenched regulatory scepticism.

The country’s securities and prudential watchdogs, tax office and central bank have all urged caution.

“These are highly volatile products and over-exposure can lead to substantial losses,” a spokesperson for the Australian Securities and Investments Commission said in an emailed statement, regarding crypto.

Asic encourages consumers to consult an accountant or financial advisor prior to setting up an SMSF. — Bloomberg