- The BTCUSD pair has gained 252.53% in the last year, while ETH has gained 591%.

- Bitfarms, a BTC miner, declared that it had mined 391 new BTC in July 2021 with a 99% clean energy production mix.

- Ethereum investors were preparing for the London Network Upgrade (LNU) set to occur on August 5, 2021.

Bitcoin rose above $40,600 as at 3:50 pm GMT gaining more than 4% from the previous day’s close. It rose from a low of $37,318 to a high of $41,352, representing an increase of 10.81%. The BTCUSD pair has gained 252.53% in the last year after its market capitalization steadied above $760.20 billion.

Ethereum (ETH) has risen 17.62% over the past seven days, maintaining a 3.32% lead against the US dollar in the last 24 hours. Despite all the attention, the rise of BTC has not been as strong as ETH that has accumulated a 1-year change gain of more than 590%. However, cryptocurrency has been on a steady run, with investors looking at cleaner mining options.

Clean energy

Bitcoin miners have been working to establish clean energy mining techniques for the crypto giant in Q3 2021. Tesla CEO, Musk announced that the electric auto manufacturer would again accept Bitcoin payments once miners demonstrated that they used 50% clean (renewable) energy. Apart from speculative demand, adoption by large multinationals such as Tesla is also a key driver to BTC rally.

Bitfarms, a BTC miner, declared that it had mined 391 new BTC in July 2021 with a 99% clean energy production mix. With a daily average of 13 BTC, the miner has worked to produce clean crypto with a 69 MW hydropower facility. The capacity of the hash rate stands at 1,420 H/s.

China’s crackdown

BTCUSD fell below $30,000 after China announced its crackdown on cryptocurrency miners in the country.

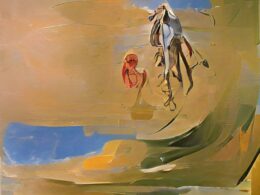

Figure 1 BTC steadying past $40,000

The pair peaked above $42000 in late July 2021 as buying pressure mounted as investors were hopeful of increased mining despite China’s crackdown.

Additionally, miners re-evaluated their options seeing the People’s Bank of China is on course to release its digital yuan.

London Fork

Ethereum investors were preparing for the London Network Upgrade (LNU) set to occur on August 5, 2021. Before the upgrade, ETH has risen close to 4% as of August 4, 2021, established by a streak of daily gains. The upgrade is touted to happen with the ETH at a block height of 12,965,000 bringing into focus the Ethereum 2.0.

The London hard fork (or the Ethereum Improvement Protocol- EIP 1559) will make it easy for investors to predict fees rather than rely on bids to allow processing. Under the EIP-1559, ETH will have higher fees in a busy market than in a quiet trading platform.

Figure 2- The ETHUSD price has risen in August 2021 before the upgrade.

The upgrade will allow users to pay the coin miners a transaction fee or a tip since the payment will be calculated automatically. Ultimately, users will be able to predict the transaction fees for the coin under the EIP-1559. Investors also foresee a limitation of the ETH supply, which will impact the price of the coin.

ETH is headed towards $3,000 based on the continuous uptrend in the week leading to August 5, 2021.

Technical analysis

The BTCUSD pair began a downtrend on May 10, 2021, after it hit resistance and confirmed a bearish movement at $59,603.00. This decline came after the pullback from the high of $63,580.40. It found support on May 24, 2021, when the price declined to $28,600.

The pair has traded in the range of 28,600-41,090.60. At a high of $41,352, it shows that the pair has pierced the key level of $41,000 (despite falling again below $40,000) and is looking to maintain the bullish trend. There is also heightened buying pressure with the 14-day RSI at 63.66.