Summary

- The institutional outlook for BTC remains strong.

- Increased adoption of BTC by institutions is leading to a change of opinion by skeptics.

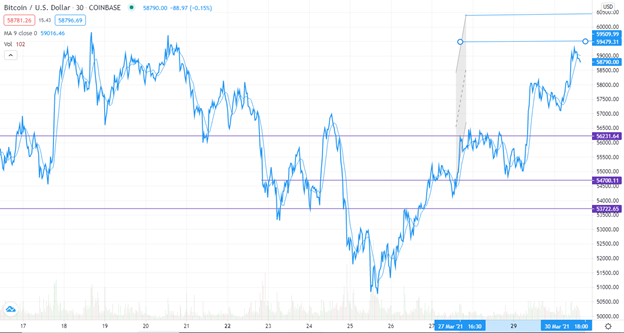

Bitcoin continued with its upswing today, climbing up by 1.6% over the price recorded in the previous 24 hours. BTC has had a good run over the past few days, and its market capitalization is now $1.1 trillion. At the time of writing, the BTC price was $58,796, which was 6.3% higher than the price seven days ago. Bitcoin has now gained 101% year-to-date.

Positive institutional outlook

On the institutional front, Visa has in the past week joined the Bitcoin bandwagon. The credit card provider announced that it had started handling transactions in USDC with BTC partners. Yesterday, the company received its first settlement in USDC over the Ethereum network from Crypto.com. Visa has plans of extending these offers with other partners.

Elsewhere the president of Oakland A’s team, Dave Kaval, recently revealed that the American pro baseball team was considering holding the BTC it would receive after the sale of its suites. Kaval further expressed optimism over Bitcoin’s price, adding to a growing number of institutional heads who are convinced about BTC’s strength as an investment asset.

In an interesting development, a YouTube content creator, popularly known as stacksmashing, has recently converted his Nintendo Game Boy into a machine that mines BTC. The YouTuber added that he was inspired by the announcement by Elon Musk to start accepting BTC as payment. The interesting fact is that the machine runs on batteries (four AAA batteries), unlike the devices used by mining firms that consume a lot of energy.

Cathie Wood, ARK Investment Management founder, CEO, and CIO is also optimistic about Bitcoin. She has highlighted Bitcoin’s high market capitalization, rising demand, and limited supply as key aspects that could trigger a spike in prices.

The Mayor of Miami, Francis Suarez, has called for the United States to consider mining Bitcoin for the benefit of the environment. In his defense, he has opined that the US uses nuclear energy, which is clean and green, unlike other countries which use energy from unclean sources.

Changing times for institutions

Positive institutional affinity towards BTC is on the rise, and even skeptics are now keen on getting a piece of the action. Howard Marks, Oaktree Capital Management co-founder, and co-chairman has recently changed his perspective on Bitcoin. He revealed that his previous negative perspective on Bitcoin has been neutralized by rising institutional adoption rates.

As BTC continues to assert its status as an investment asset, more institutions are likely to purchase it.

In a similar development, Øystein Stray Spetalen, the founder of Standard Drilling Plc and Standard Drilling ASA, has had a change of heart regarding Bitcoin. Spetalen had been a long-time critic of Bitcoin, pointing out its high energy consumption as a turn-off.

The threat that’s here to stay

Regulatory concerns about Bitcoin also keep emerging by the day. A regulator in South Africa, the Financial Sector Conduct Authority, has recently given a warning after it detected increasing cases of losses related to digital currencies. Furthermore, the regulator stated that it was looking into measures that would regulate specific features and participants in the digital currency community.

In India, digital currency exchanges are engaging the minister of finance and the country’s central bank to find ways on how digital currencies could be regulated. The move comes a few days before the forthcoming ban on BTC in the country.

BTC/USD technical outlook

Bitcoin will find first support at $54,700 and second support at $56,231. The Relative Strength Index (RSI) is currently above the midpoint, indicating a bullish trend. This could push the price to the first resistance at $59,479, beyond which the second resistance level will be at $60,500.