The Bitcoin price crashed in the overnight session as investors reflected on the big announcement by Tesla and the latest consumer inflation data. The currency fell by 20% to a multi-month low of $46,000 and quickly rebounded above $50,000. This price action implies that the Grayscale Bitcoin Trust (GBTC) will also open lower on Thursday. The fund is down by more than 25% from its year-to-date high.

Tesla turns sour on Bitcoin

In February, Elon Musk surprised the market when he revealed that the company had acquired Bitcoin worth $1.5 billion. In his statement, he also said that the company would start accepting digital currency in its stores. The news helped incentivize more companies to add the currency into their balance sheet. As a result, the currency surged to an all-time high of $64,875 in April.

On Wednesday, Musk changed his decision and announced that the company would stop accepting the currency. He cited the environmental impact of Bitcoin mining. Most of Bitcoin in existence today is mined in countries like China that generate most of their energy from coal. In the tweet, he said that the company would start looking for a cryptocurrency that does not consume a lot of energy to produce.

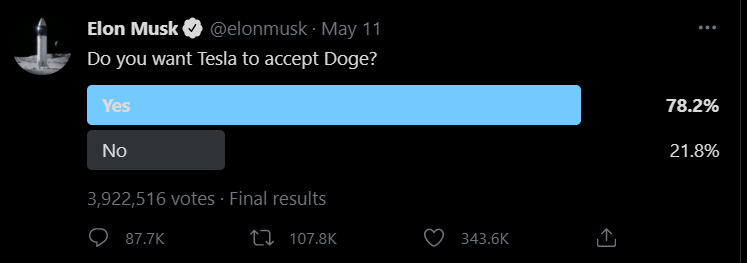

In a separate poll, he found that 78% of the respondents were supportive of the company turning to Dogecoin.

In his Tweet on Bitcoin, Elon Musk did not disclose whether Tesla had decided to sell the remaining Bitcoins it owns. Also, the company did not provide evidence on the number of vehicles it sold using the currency in the first quarter.

The decision by Tesla was criticized by Bitcoin enthusiasts, as evidenced by its price action. Indeed, some Twitter members criticized the company for its hypocrisy. For one, most Tesla vehicles are charged using electricity that is generated from coal. Also, the mining of products used to manufacture Tesla vehicles and batteries has been criticized for damaging the environment for years.

Inflation concerns

The Bitcoin price also declined because of the latest inflation data from the United States. On Wednesday, data from the United States showed that the headline Consumer Price Index (CPI) rose by 4.2% on a year-on-year basis in April. This was a higher number than what most analysts were expecting. It was also the highest number in more than 13 years.

The data came a day ahead of the latest producer price index (PPI). Economists expect the data to show that the headline consumer price index (CPI) rose by more than 5% in April. Furthermore, the prices of most commodities consumed by companies have surged. Lumber has risen by more than 340% while gasoline, iron ore, and copper have more than doubled in the past 12 months.

These numbers are important for Bitcoin prices because of the impact on interest rates. For months, Bitcoin and other cryptocurrency prices surged because of the relatively low interest rates by the Federal Reserve. Therefore, there is a possibility that these assets will be pressured when the Fed starts to tighten.

Bitcoin price forecast

On the daily chart, we see that the BTC price has been in a tight range recently. It declined to a low of $46,000 after the inflation data and announcement by Tesla.

Still, the pair seems to be forming a bullish flag pattern that is a continuation pattern. However, it has also moved below the 20-day and 50-day moving averages, which is a bearish signal. It has also formed the Head and Shoulders pattern. Therefore, the bearish breakout pattern will be confirmed if the price moves below the overnight low of $46,000.