Bitcoin has posted liquidations of more than $532 million, trailed by Ether, which has $317 million amid cryptocurrency bearish sentiment.

The futures tracking Cardano’s ADA, Stepn’s GMT, and BNB had more than $6 million in liquidations, with some 213,000 individual accounts liquidated in the past day. Solana’s SOL tokens recorded liquidations of about $20 million.

Long traders had more than $510 million in liquidations, while the short traders had $554 million in losses. The numbers show that the futures traders contributed to the market volatility and impacted traders equally.

Cryptocurrency exchange FTX had the most liquidations at over $417 million, while OKX and Binance recorded $251 million and $198 million, respectively.

Liquidations are scenarios where exchanges forcefully close a trader’s leveraged position due to partial or total loss of the initial margin. This occurs when the trader cannot meet the margin requirements for a leveraged position.

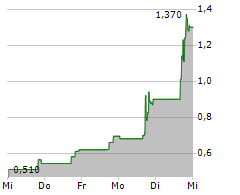

The trend comes after bitcoin lost a major support level at $25,000 on Monday, with the market capitalization falling to the price last seen in January 2021. Major tokens dropped by an average of more than 15%.

Source: Coindesk