Liquidity providers are useful players in the financial market. They are used in all assets offered to traders like stocks, currencies, and cryptocurrencies. In this article, we will focus on liquidity providers in the blockchain industry and see how they work and how their prices and rewards work.

Decentralized Finance explained

To understand what liquidity provider tokens are, it is important that we look at what decentralized finance (DeFi) is and how it works.

DeFi is a type of finance that is not controlled by a central authority. For example, in a bank, the key decision-makers are the senior managers. These entities make the top decisions on who to accept as a customer and the interest rates to charge them.

The idea behind DeFi is to eliminate the central planner by letting people make decisions amongst themselves. For example, instead of letting Coinbase set your trading fees, you can use a decentralized entity that does not even ask for your private information.

Today, DeFi is attempting to change the financial industry in multiple ways. For example, lending platforms extend credit to any borrower who has collateral in the form of cryptocurrency. Further, DEXEs make it easy for people to buy and sell assets in a decentralized manner.

What is a liquidity provider?

Liquidity providers are important players in the financial market. They help to ensure that all assets like stocks and cryptocurrencies are traded in a smooth manner. For example, in stocks, whenever a user places a trade in a platform like Robinhood, the company usually routes the trade through a liquidity provider known as a market maker. Examples of top stock market makers are Citadel and Virtu Financial.

The same concept applies in the decentralized finance industry. For DEXes and other lending platforms to work well, they need to have liquidity. Since they are decentralized, any person who owns cryptocurrencies can provide liquidity to them. For example, if you own Ethereum worth $10,000, you can provide it in a liquidity pool and generate interest from it.

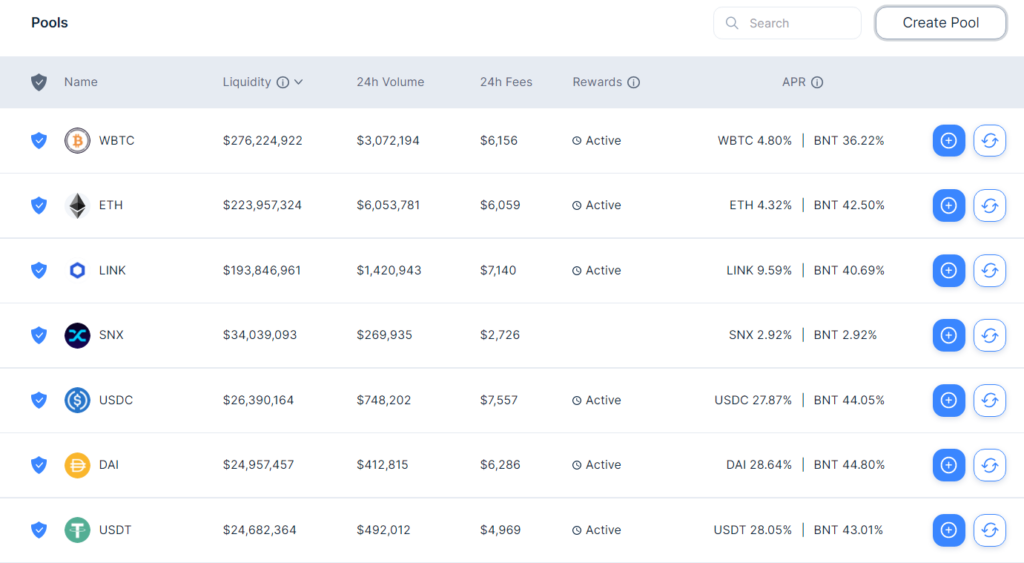

A good example of this is shown in the chart below. As you can see, there are multiple Liquidity pools that have been created. In this case, the biggest pool has Wrapped Bitcoin, which is an ERC token that is backed 1:1 on Bitcoin. We can also see that the WBTC has an APR of about 4.8% and a BNT yield of 36%. Therefore, instead of just buying BTC, you can add it to a pool and make money from it.

A good example of this is shown in the chart below. As you can see, there are multiple Liquidity pools that have been created. In this case, the biggest pool has Wrapped Bitcoin, which is an ERC token that is backed 1:1 on Bitcoin. We can also see that the WBTC has an APR of about 4.8% and a BNT yield of 36%. Therefore, instead of just buying BTC, you can add it to a pool and make money from it.

Liquidity provider tokens rewards explained

In the centralized world, liquidity providers are paid by brokers based on each trade that they execute. As such, since trillions flow through them every day, it is a highly lucrative industry to be in.

The same compensation process works in the decentralized finance industry. As shown above, each cryptocurrency or stablecoin has the associated APR. Therefore, holders of LP earn interest in the form of APR.

The APR is generated from the fees that customers are charged whenever they do a transaction. For example, in a DEX, the fee comes from the commission that the customer is charged when they execute a trade.

In the example above, we can see that the 24-hour volume for ETH was over $6 million. By processing these funds, the pool earned a fee of over $6,000. These funds are then provided to the liquidity tokens. As such, you can see how the figure can add up in a long time.

There are also rewards that come from what is known as farming. A pool with an APR will typically provide interest every day.

What are the risks of investing in LP tokens?

Like in all assets, there are risks associated with investing in liquidity pools. Indeed, in a report published in November 2021, it was estimated that about half of all liquidity providers in Uniswap were losing money.

There are multiple risks associated with liquidity provider tokens. First, while activity in the DeFi industry is increasing, there is a risk of little activity in your liquidity pool. This could happen when there is significant volatility in the financial market.

The other main risk is known as impermanent loss, which happens when the price of the cryptocurrency that you hold drops. For example, in February 2021, the prices of most coins declined sharply. As such, the returns in the liquidity pools did not compensate for the rewards offered. This explains why most people use stablcoins like the USD Coin and Tether.

Examples of top liquidity pools

There are many liquidity pools in Decentralized Finance. Some of the most popular ones are Uniswap, PancakeSwap, Bancor Network, and DYDX.

Uniswap was one of the first DeFi platforms in the world. It was initially built on Ethereum’s network, but developers have launched multiple versions on other chains like Polygon and Arbitrum. Uniswap enables people to swap their cryptocurrencies by just connecting their wallets. It has a total value locked (TVL) of over $7.53 billion.

Bancor Network is another Ethereum-based token that is popular among investors looking for yield. It allows people to create their liquidity pools and then earn returns. To achieve that, Bnacor has partnered with other DeFi platforms like Gnosis, Civic, and Aragon. It provides these platforms with liquidity. Bancor has over $1 billion in assets.

The other most popular liquidity pools you can use are Abracadabra, Lido, and Balancer.

Summary

In this article, we have looked at the concept of decentralized finance and examined the important idea of liquidity pools. Further, we considered how rewards work and some of the most popular liquidity tokens you can use.