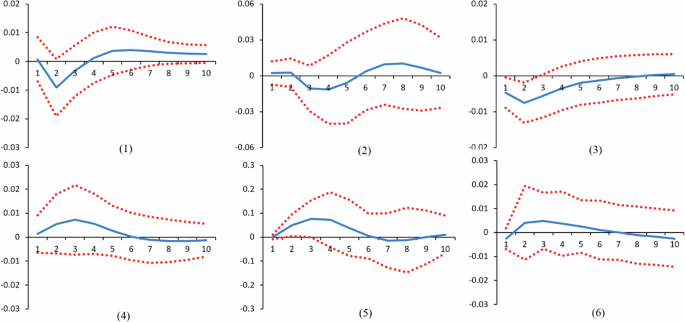

This study examines how commodity financialization — marked by surging capital inflows and new financial instruments like ETFs — affects commodity pricing dynamics by analyzing inventory-linked convenience yield and investor behavior. Based on the extended theory of storage, using futures market data from 1994 to 2021, this paper examines the efficiency of the factor models in capturing financialization in commodity markets. Furthermore, Fama-MacBeth regression, structural vector autoregressive (SVAR) model, and several statistical indicators are adopted to illustrate the roles of heterogeneous investor behavior in explaining and forecasting commodity pricing. The empirical results can be summarized as follows. Firstly, a financialization-inclusive two-factor model outperforms a single-factor model in aligning with actual commodity futures prices and their term structure. Secondly, non-commercial traders dominate trend-following trades, while commercial traders dominate counter-trend trades. Thirdly, heterogeneous investors’ positions have both short- and long-term predictive effects on commodity prices. In summary, this paper demonstrates the importance of investor behavior for commodity pricing and provides policymakers with regulatory insights.

Compared to traditional stocks, bonds, or currency markets, commodities represent a unique asset class. Before the 21st century, commodities played an important role in hedging the risk of traditional financial asset positions due to their low (and even negative) price correlation with traditional financial assets (Gorton and Rouwenhorst, 2004). The typical market composition of the commodity futures market consists of speculators holding long (short) positions and obtaining risk premiums from producers (consumers). In this manner, traditional participants or commercial traders (producers and consumers, i.e., hedgers) hedge against the price volatility risk of their physical positions in the spot market. After 2000, significant capital flowed into the commodity market (Irwin, Sanders, 2015), with emerging financial instruments such as commodity index products (Basak and Pavlova, 2016) and exchange-traded funds (ETFs) providing channels for new capital inflows, characterized by low trading costs and convenience of on-exchange trading. Unconventional participants in the commodity market engaged in on-exchange trading through these financial instruments, exacerbating the volatility of commodity prices and leading to a general rise in prices. Domanski and Heath (2007) referred to this phenomenon as the “financialization of commodities.” The phenomenon of financialization has resulted in greater synchronization of commodity prices with traditional financial markets, and the increase in this price correlation, which has weakened the hedging effect of commodities, has been discussed by numerous scholars (Creti et al., 2013; Basak and Pavlova, 2016; Adams et al., 2020).

Regarding the causes of financialization, there is considerable debate in the existing literature. Many scholars believe that this phenomenon arises from fundamental factors of demand and supply, while others attribute the rise in prices and volatility to the presence of a large number of financial investors in the commodity markets. Nevertheless, almost all scholars agree that the financialization of commodities leads to increased volatility and a reduced correlation with the stock market. The literature includes numerous empirical analyses and modeling approaches, with arguments concerning the causes of financialization primarily including: inventory behavior theory (Kilian and Murphy, 2014; Kilian, Lee (2013); Juvenal, Petrella (2015); Knittel and Pindyck, 2016; Martínez and Torró, 2023; Milonas and Photina, 2024), information friction theory (Singleton, 2014; Sockin and Xiong, 2015), and intermediary pricing theory (Cheng, Kirilenko, and Xiong, 2014), among others.

As for model construction, classic models for pricing commodity futures contracts include variables related to physical trading (producers and consumers), such as convenience yield. Convenience yield refers to the benefits that the physical holder of a commodity derives, rather than the holder of a futures market position. The concept of convenience yield originates from the theory of storage, tracing back to the research of Working (1949) and Telser (1958). Convenience yield can explain the price differentials between futures contracts with different expiration dates. While it cannot be directly observed, it can be estimated based on historical futures prices. In models where convenience yield is treated as an exogenous random variable, it plays a significant role in explaining price fluctuations and changes in futures prices (Gibson and Schwartz, 1990). In the term structure equilibrium model developed by Routledge et al. (2000), convenience yield is set as an endogenous variable to predict volatility across different maturities. Geman and Nguyen (2005) noted that the volatility of spot prices is inversely related to inventory levels and utilized this relationship as a state variable to explain changes in futures prices. In summary, in recent literature, convenience yield has become a popular state variable for explaining the different shapes of forward curves.

Theoretically, under normal circumstances, equilibrium prices are determined by supply and demand at equilibrium. In general, convenience yield should exhibit an inverse relationship with inventory levels. In situations of high prices (indicative of strong demand), inventory levels are low, while convenience yield is high. However, during periods of speculative trading in the market, prices will exceed theoretical equilibrium prices. This implies that producers, incentivized by high prices, will increase supply, leading to a surge in inventory and consequently a decline in convenience yield (Martínez and Torró, 2023). One of the reasons for the increase in commodity prices is the presence of a significant number of financial traders engaging in speculative activities. In this scenario, as prices rise, inventory increases while convenience yield decreases. Compared to non-speculative periods, this presents an anomalous situation (where prices rise while convenience yield falls) (Cheng and Xiong, 2014). Therefore, this article will model and analyze the fitting effects of convenience yield (as a proxy variable for inventory) during the period of commodity financialization, both with and without its inclusion.

The purpose of this study is to verify the significant impact of financialization factors on commodity pricing and provide a theoretical basis for the influence of investor behavior on commodity pricing. To achieve this purpose, this paper analyzes the efficiency of the two-factor model to describe the term structure of futures prices compared to the one-factor model. Based on the fundamental research framework of the theory of storage, this study provides a theoretical basis for how investor behavior affects commodity pricing. Due to the difficulty of precisely measuring inventory levels, convenience yield, therefore, becomes an important proxy variable for inventory (Einloth, 2009; Boyd et al., 2018). To be specific, first, this paper uses the entire term structure of futures prices (different maturities of futures contracts) to estimate convenience yield. Second, both the pre-financialization and financialization periods are compared in different models. Additionally, this paper explores the relationship between speculative trading and price volatility of commodity futures from the perspective of heterogeneous investor behavior, offering a new explanation for the anomalous convenience yield effect in commodity pricing models.

The research findings indicate that: (1) during the financialization period, models that incorporate convenience yield factors fit empirical data better (exhibiting smaller in-sample errors), and financialization did not alter the capability of convenience yield to describe the term structure; (2) heterogeneous investors exhibit opposing trading behavior characteristics, with non-commercial traders engaging in trend-following trades while commercial traders engage in counter-trend trades; some results suggest that price increases are driven by speculative trading; (3) the positions of heterogeneous investors demonstrate both short-term and long-term predictive effects on commodity prices. The marginal contribution of this paper is that it expands the perspective of financialization for commodity pricing under the framework of the theory of storage, and provides the theoretical basis for comparing the pricing efficiency of such models before and after commodity financialization; Taking commodity financialization and financial crisis as the time node, we find the prediction effect of heterogeneous investor behavior on commodity pricing, which provides empirical evidence for the liquidity and premium source of commodity market.

The rest paper is structured as follows. The second part introduces the relevant literature review, the third part proposes model and research hypothesis, the fourth part describes the data used and the sub-sample division, the fifth part conducts empirical analysis and compares the fitting effect of the model, the sixth part further explores the prediction effect of heterogeneous investor behavior, the last part summarizes the research conclusion.